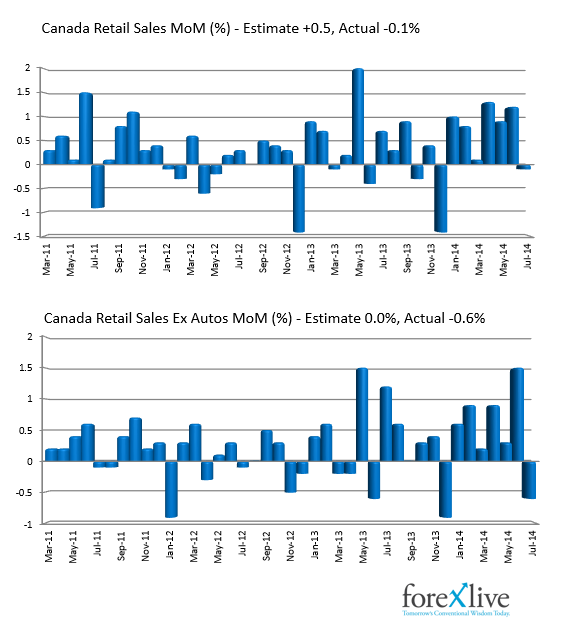

The USDCAD is back higher on the back of the weaker Canada Retail Sales for the month of July. The good news is the prior three months were pretty good. So a decline may be expected.

Canada Retail Sales come out weaker than expectations for the headline and the ex Auto component.

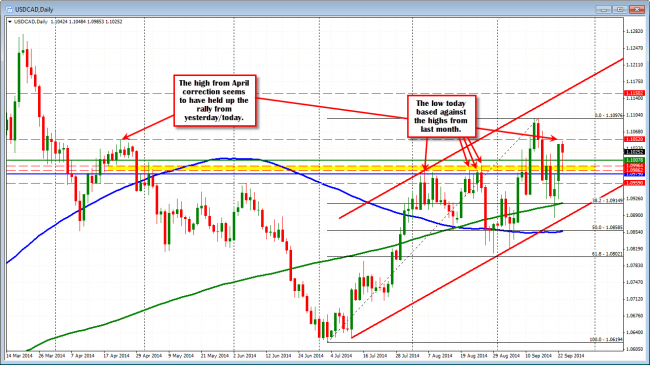

If you recall from yesterday, the pair rocketed higher in trading. Today, it ended up correcting 38.2% of the move higher (since Friday low) but is coming up short of the high from yesterday at the 1.1052 level. Keep an eye on the 1.1022-1.1030 area as close support. This has been highs and lows over the last few weeks of trading. Stay above the buyers may take a run at the highs.

Technical Analysis: USDCAD moves back higher on the back of weaker Retail Sales

Looking at the daily chart below, the high from April 23rd comes in at 1.1052. This was a corrective high before the move to the years low reached in July 2014. The price of the USDCAD moved above this high earlier in the month for two days – rising to a high of 1.10976. However, the momentum could not be sustained.

The data was worse but the prior months were not too bad. One month does not make a trend but given the weakness yesterday the market has been supported. Watch the yellow area for momentum clues. If that level fails, the 200 hour MA will become the next level of support intraday (at the 1.1008 level currently (green line).

Technical Analysis: Daily chart of the USDCAD shows some resistance against an old high.