The EURUSD has moved 204 pips from the high to the low this week. The expectations from the weekend YouTube video report (CLICK HERE TO REVIEW THAT REPORT), was for a more trend like week after the non trending period we were mired in over the previous two weeks. We are on our way and the shorts have indeed benefited.

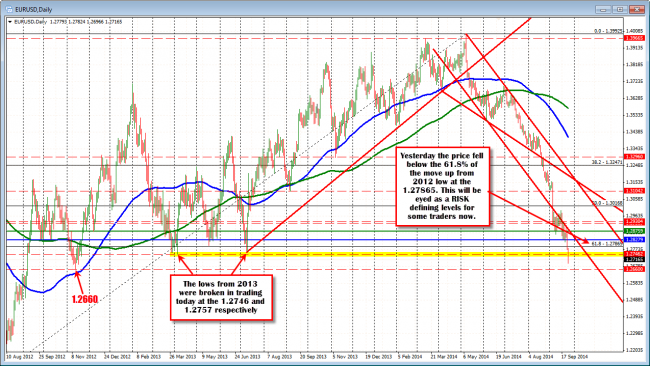

Technical Analysis: EURUSD falls below 2013 lows in trading today.

The pair today extended below the next targets at the 1.2746-57 area. These were the low levels from 2013 and will now be risk defining levels for traders today. Yesterday the price moved below the 61.8% of the move up from the 2012 low to the 2014 high. That level comes in at 1.27865. This level may also be a risk defining level. The trend continues to be down. Prior to this week the pair consolidated for 11 or so trading days (post the ECB cuts) and so this week represents a continuation of the trend move lower that started when the price peaked at 1.3992 in May. The next major target is the November 2012 low at the 12660 level now.

Looking at the hourly chart below the trend move lower this week has stepped down nicely since the corrective high price on Tuesday. If the sellers are to remain in control, the price should stay below the 2013 lows. IF that area is breached, another region to eye for bias clues would be the 38.2%-50% of the move down this week. The area comes in currently at the 1.2774-1.2798 area (see chart below). If the sellers like being short (i.e. intermediate and longer term traders), they should love being able to sell against a 50% correction line from the trend move lower this week. If not, that might be a clue, that the price has gone too far (I don’t expect a move above, but….I am not the “market”. So risk has to be defined).

The trend lower this week has taken the pair down from 1.2900 to 1.2696 or 204 pips. If the trend is to continue, traders will be eyeing broken levels.

Has the pair gone enough for now?

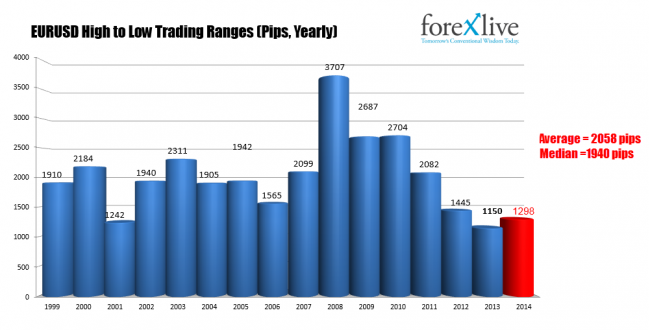

FOREX TRADING TIP: One way to gauge potential exhaustion is to look at longer term high to low ranges. I like to look at the range for calendar years. Up until July when the price finally fell below the February low, the range for the year was less than 520 pips – half the lowest trading range ever. The lowest trading range for the EURUSD in it’s history going back to 1999 was last year at 1150 pips (see chart below). Needless to say there was room to roam and indeed the “market” obliged. It just did not make sense to have a trading range for a year at half of the lowest on record.

The last 148 pips lower has now taken the year range above the lowest range ever (that was last year at 1150 pips). The current low to high trading range is 1298 pips. It is now (thanks to today’s range extension lower) above the 2001 trading range.

Can the range extend further? Of course it can. As the chart shows, we are still near the bottom of the ranges over the pairs history. The average over the life of the EURUSD is 2058 (over 15 years). The Median is around 1940 pips.

Is there reasons for the narrowing trading ranges in recent years? Increased regulation, scandals, policies in sync with each other are some of the reasons. The in sync policies are out of balance now, however, and that is favoring the USD over the EUR and helping to contribute to the trend (regulation and forex scandals have likely reached the bottoms as well). As a result, maybe going another 700 pips is not possible (it would take the EURUSD toward 1.2000), but there is potential for something more (i.e. a further extension lower). Just something to keep in mind. I still focus on the price and the tools for trading decisions. This is a secondary tool to wrap my mind around what could happen.

The low to high trading ranges for the EURUSD for a calendar year (Jan to Dec 31)