Jawboning a currency down is a fine art.

- Speak about doing it but not acting may get you one or two moves in your favour before the market thinks you’re crying wolf.

- Actually intervening will obviously work, unless there’s forces on the other currency which holds the balance of power (USD being the big one) and you just end up pissing into the wind

- Jawboning about intervention when the bias is on your side and the market is already capitulating

The long and short is that intervention is often a difficult task, especially for a smaller nation, and especially when you want your currency lower. The RBNZ has intervened before but could do little to stop the currency running up to 0.88+ over the last year or so. The USD was in charge and that was that. Now that the market is really believing in the US economic recovery and the end of QE the dollar rally is changing the tide for currencies like AUD and NZD. There are domestic fundamentals at play too, like dairy prices but most of the moves are USD driven.

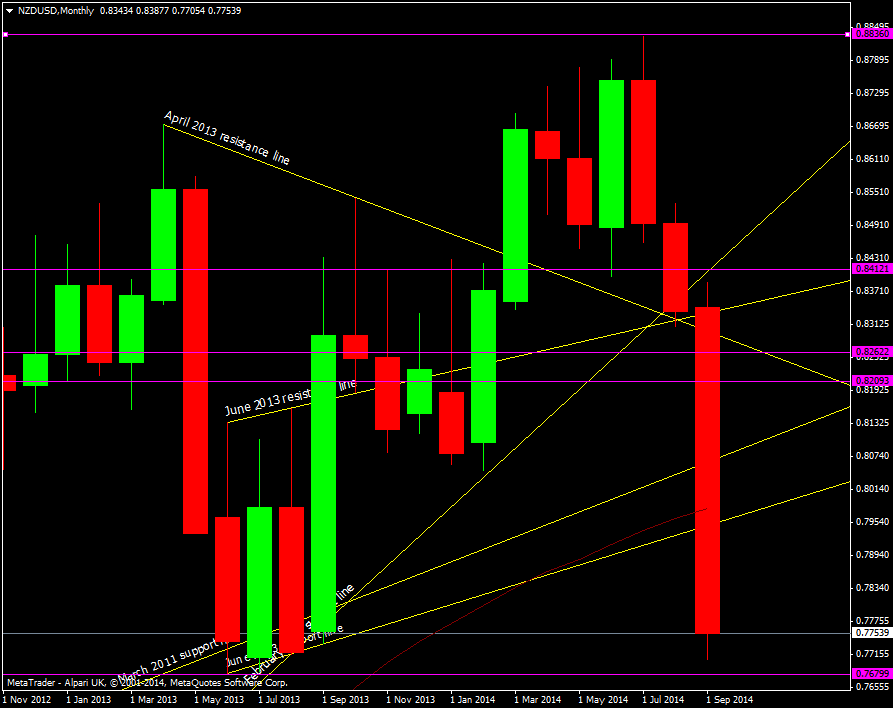

The rise from the 0.7680 low in June 2013 took 13 months to reach the 0.8834 high in July 2014 and has taken 2 to unwind.

NZD/USD monthly chart 29 09 2014

That’s swift in anyone’s book but at the moment it’s still not something I would look to fade. With USD/JPY getting a kick above the recent highs we’re very likely to get a test on 110 and that will keep the pressure on the kiwi. Add the possibility of further intervention and a the market liquidating longs then the RBNZ can just kick back and let us lot do the work for them.

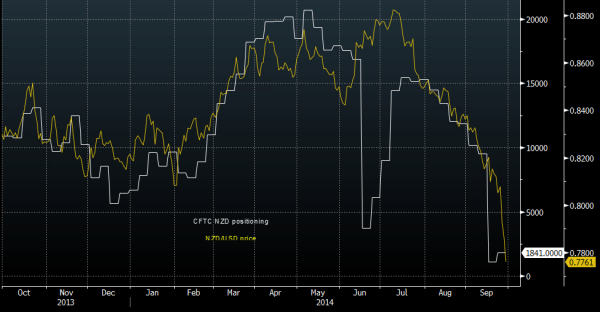

NZD/USD futures positioning vs price

As you can see from the chart above, longs have been running out the exit door as the price crumbled.

So is the next target the New Zealand government’s preferred level of 65 cents? I very much doubt it but we shouldn’t rule out any further big drops from here. The force is with the USD and until that shows signs of abating, going long the kiwi is going to be a dangerous trade.

That’s not going to dissuade many of you though is it? Such a big loss in such a short space of time must be screaming “oversold” isn’t it? Possibly, but where do you want to catch that knife?

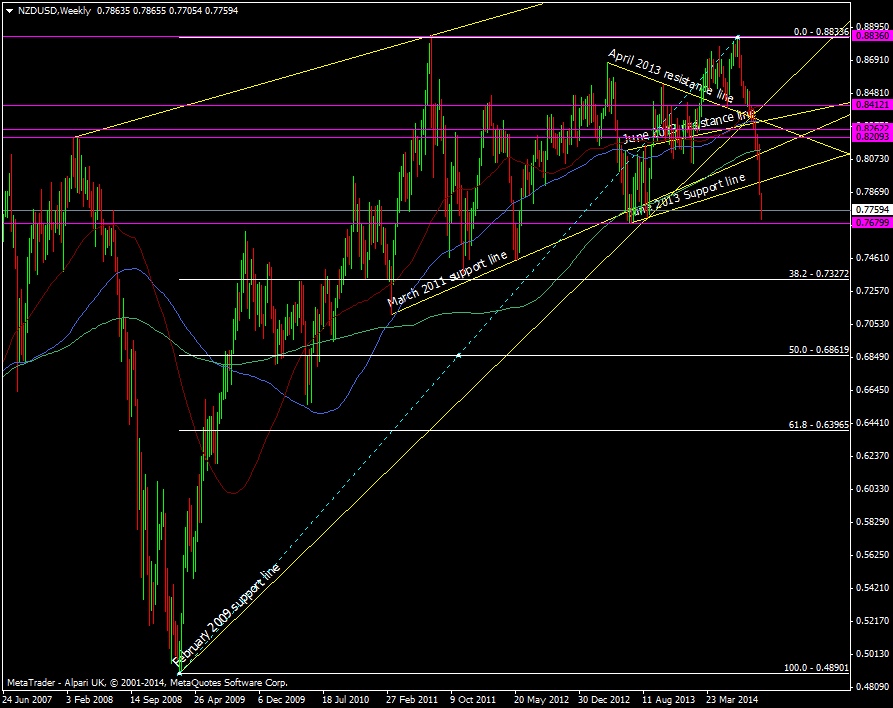

Just under 100 pips from there we have the 2013 lows at 0.7680. Technically it looks a decent level to look for a bounce but there’s not a lot under there until the 100 mma at 0.7484 and the May 2012 lows at 0.7450

NZD/USD weekly chart 29 09 2014

Under there we hit the 38.2 2008/2014 fib at 0.7327. A lot of thin air to the downside and as we’ve seen in a few pairs now, these multi year levels aren’t holding up to much.

Selling any rallies looks to be the trade going forward and up towards 0.7900/15, 0.7960 is where I would look first, then 0.8040, 0.8080/90 and 0.8200. If you really want to whet you kiwi buying appetite then maybe looking elsewhere for longs may be the best advice.

The trend is in place and all the factors are pointing down. It’s not the time to fight this yet.