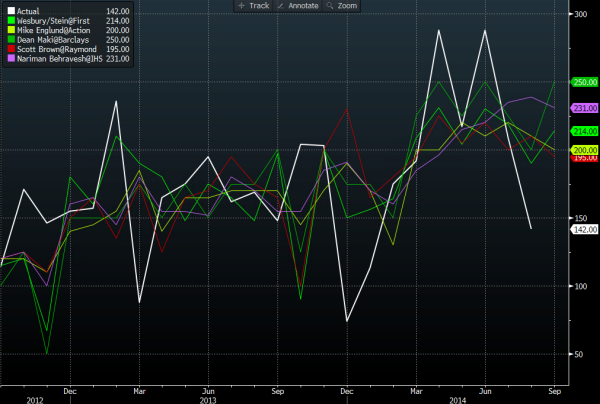

Time to look at who is best at reading the tea leaves and plucking the NFP number out of the hat.

Last month’s surprising drop in jobs caught many on the hop and there were some changes in the league table.

The top 5 going into this month (including today’s estimates) are as follows;

- Westbury/Stein – First Trust

- Dean Maki – Barclays

- Scott Brown – Raymond James

- Nariman Behravesh – IHS Global

- Mike Englund – Action Economics

NFP top pickers 03 10 2014

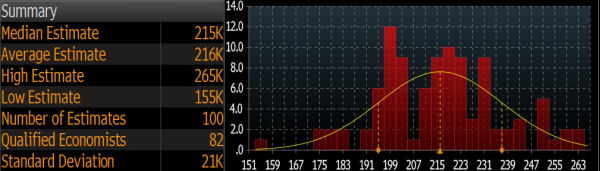

Here’s how the market estimates are looking overall.

NFP by the numbers 03 10 2014

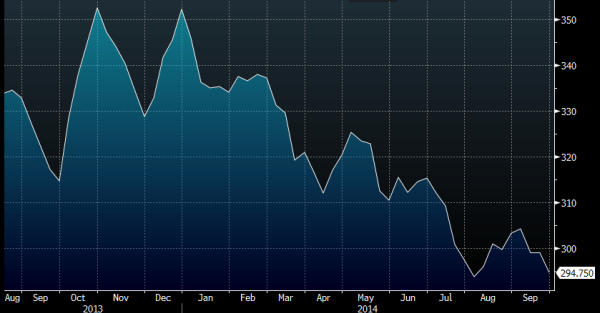

Often the weekly indicators like MBA mortgage data and Initial jobless claims aren’t given the credit they deserve and perhaps we should pay more attention to them. On the jobless claims 4 week average chart we can see that we should have been a bit more concerned about the payrolls numbers last month.

Initial jobless claims 4 week average

It’s by no means a definitive indicator but it’s well worth keeping tabs on to get an overall idea of the jobs market. As we see from the chart, claims are falling once again which possibly shows that we’ll be getting an NFP number back around the running average.

A second low number in payrolls is really going to get the market asking questions. One big drop in a run of around 200k gains a month is brushed off as a one off. Two on the trot will have the market thinking something is seriously wrong.

Today it looks like the market is gearing up for a return to a decent number. The dollar has found its feet again as we bump along the 109.00 line in USD/JPY. If we get a good number I’m cautious over the upside potential. We’re still in a sentiment that the jobs market isn’t a problem and ticking along nicely, but now we’re seeing a slight change in sentiment over the rest of the economic data. If a market has something it doesn’t have to worry about (jobs) it will go looking for something it can worry about, like poor spending and manufacturing data, we saw this week.

I feel we’re at a pause phase in the dollar and a good jobs number might not be the kicker to take us out of that. The bigger risk is a bad number.