USD/CAD is once again testing the annual high of 1.1279 and as the US dollar continues to strengthen, there’s a good case for buying the pair but oil isn’t one of those reasons.

The two main global oil benchmarks are WTI and Brent. To be sure, both have absolutely cratered in the past few months but they aren’t the only benchmarks.

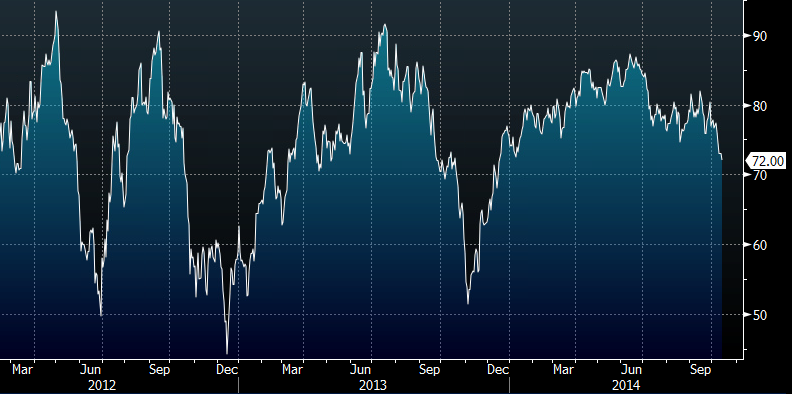

The vast majority of Canadian oil is priced around Western Canada Select and the pain the market market is nowhere near what we’ve seen in WTI and Brent.

Technically, it looks weak and the USD/CAD also looks like it’s on the cusp of a breakout, but it hasn’t happened yet. In the meantime, keep a close eye on it.

Western Canada Select

Meanwhile, there is talk about some light speculative offers at 1.1260/70, corporates selling up to 1.1275 and a barrier at 1.1300 with buy stops above.

Tread carefully.