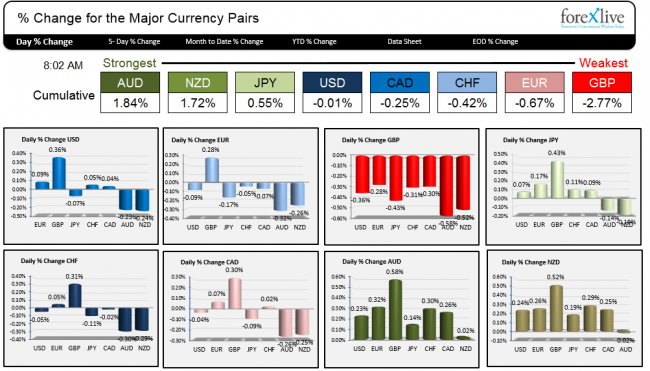

The AUD and NZD are the strongest currencies today. The gains are fairly modest, however.

The GBP is the weakest currency as BOE meeting minutes showed greater risks to the UK economy from the weakness in the Euro area.

The US dollar mixed, doing the best against the GBP. Against the EUR and JPY the greenback is little changed from the closing levels yesterday (at 5 PM ET).

The forex winners and loses in the forex market as NY traders enter

The Bank of Canada meets to day and are expecting to keep rates unchanged. The CAD is a touch weaker. The Canada Retail sales will be released at 8:30 AM with the expectations for no change from last month. The Ex Auto is expected to rise by 0.2%( for August).

For a fundamental preview of the decision from Adam Button see:

Preview: Bank of Canada decision could confuse

For a technical preview of the key levels, see Greg Michalowski’s preview at:

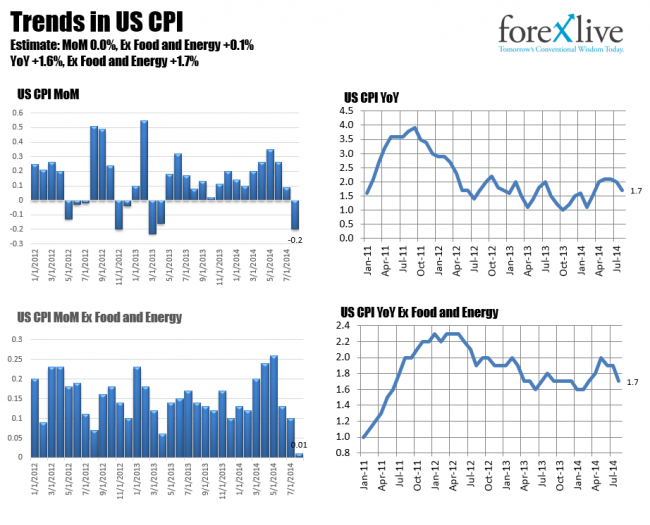

US CPI will be released at 8:30 AM with the MoM expected to show no change in the headline number and +0.1% increase in the ex Food and Energy. The trends in the CPI are outlines in the chart below:

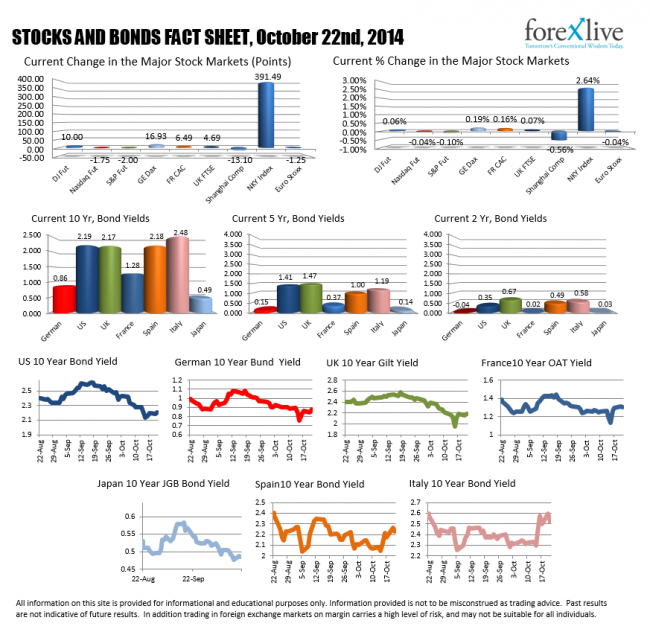

Stocks and Bonds:

The European stock market and pre-US stock market are taking a breather after the sharp rises in yesterday’s trading. German bunds and US 10 year bonds are down a basis point or two from a day ago at this time. The Nikkei rallied on the back of the US gains yesterday.

A snapshot of the stock and bond market