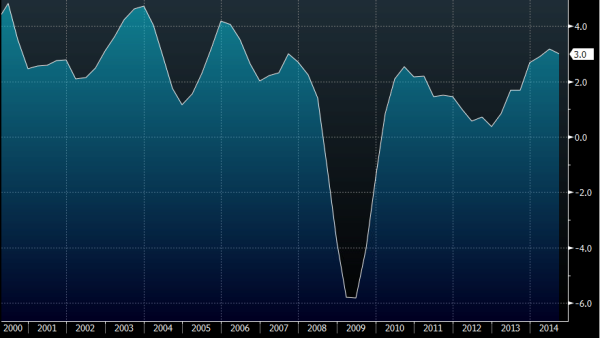

The fact that the data could have been worse is probably a small blessing as a bigger drop in growth would have really been worrying. The current slowdown we are in has been aptly reflected in the numbers. There is no great collapse in the economy and we’re a long long way from the dark ages during the crisis.UK GDP

UK GDP Q3 2014 y/y 24 10 2014

There are warning signs though, and the shadow of Europe’s spiral pulling us down with them. I see the economy now going sideways for the rest of the year and probably into the early part of 2015. We’ve still got a strong economy, we’ve still got good jobs growth, and that means more wages (weak or not) going through the economy. The housing market is being addressed and slowly, but surely, the UK is finding a more sustainable footing.

With everything going on in the world and the low global growth environment we’re not going to be seeing boom times. If we manage growth between 2% and 3%+ for the foreseeable future then that’s going to be ok in my opinion.

What does it all mean for the pound?

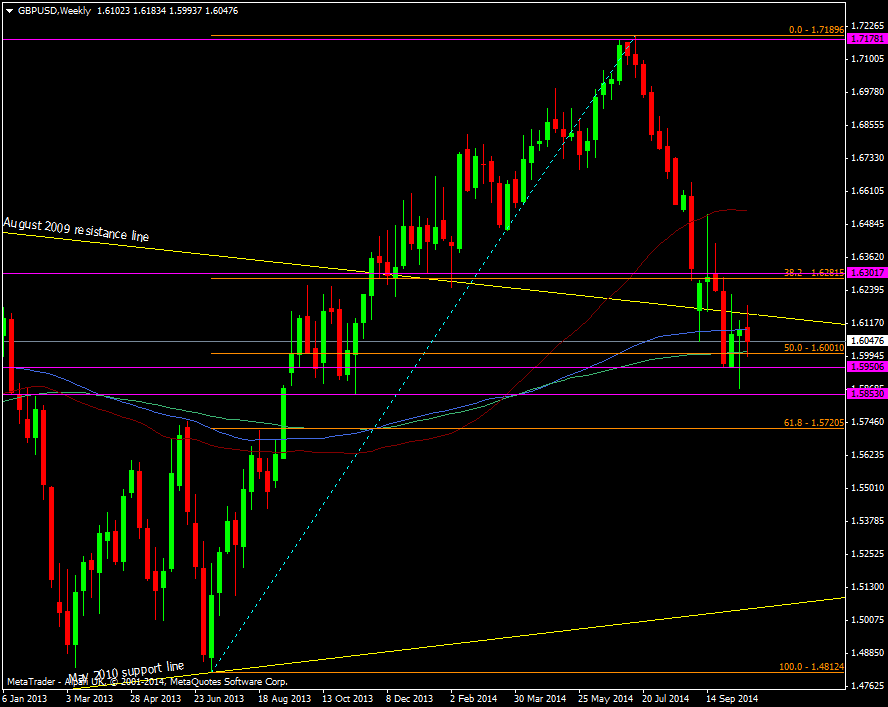

You can tell by the price action that there is some relief but also still some trepidation that the economy has confirmed the slowdown. The market may still be pushing rate rises to later in 2015 but they’re still seeing one come. The only chance we will not get one is if GDP falls to 1% or less (or some big shock appears). At some point I’m going to start loading up on GBP for when the rate rise chatter starts again. The next six months are going to shape that trade. If the US economy starts to gain traction, particularly in manufacturing, then they will pull ahead in the race to raise and that will pressure GBP/USD. At the moment there’s just as much indecision over US rates as UK rates, but once the market gets a clue we’re going to see some big moves again.

So for now I’m still dollar bullish and will load up on USD/JPY if we get another decent dip or if we break 110. I’m not keen on shorting the pound against the dollar unless the big levels go (1.5850/800) and I’m still liking EUR/GBP shorts from higher levels.

From here the pound remains in range and playing the edges is the way to go short term. At the moment you can park yourself tightly between 1.60 and 1.61 with a wider range at 1.6180/6200 and 1.5950. A break of 1.63 or 1.5850 and we’ll get a decent move either way.

GBP/USD Weekly chart 24 10 2014