The saga of the AUDUSD has continued today with choppy trading conditions today. The pair has a bullish bias from the hourly chart at least, but there has not been a spark that has continued the bullish momentum seen on Friday.

A REVIEW

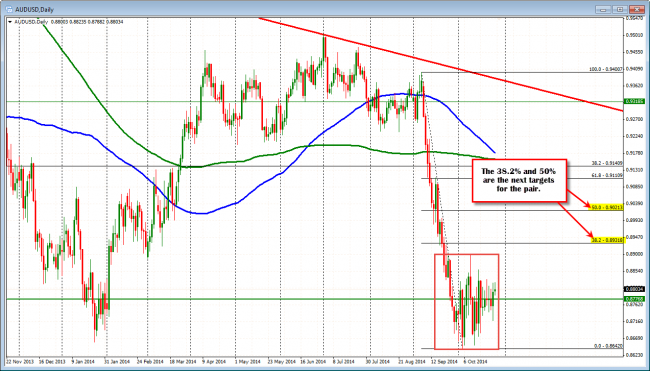

Last week, I was looking for the AUDUSD non trending range, to give way and trend away. At that time, the pair had been pushing the high and failing to extend (on Tuesday, Wednesday and Thursday). So the downside was tried on Friday and although it extended below the bottom trend line and extended the weeks trading range in early trading on Friday, the trend like move down that was anticipated, could not be sustained and shorts covered. The price rotation higher took the price back above the 200 and 100 hour MAs (green and blue lines) and the topside trend line (see chart below).

AUDUSD is staying above the broken trend line.

WHAT LIES AHEAD

The price action today has been choppy to say the least. However, the price remains above that trend line break level at 0.8786. This is the new risk level for longs. Stay above keeps the bulls in control.

I still expect that the consolidation range the pair has been in will give way at some point and the market will trend away. However, it still needs the spark.

Technically, the bias is bullish above the trend line. The next targets on a break would be the 0.8931 and 0.90213 levels which are the 38.2% and 50% of the move down from the September high (see chart below). Look for the spark and momentum. If it does not come, a move below the trend line will extinguish the flame (and a re-evaluation)

PS There is not much on the Australian calendar this week. So much will likely depend on the USD’s action.

The break higher would look toward the 38.2% and 50% of the move down in September as the next targets.