The Federal Reserve is in the midst of a two-day meeting with a statement due on Wednesday at 2 pm ET (1800 GMT).

Most market charts over the past month show a V-shaped bottom but not the one that matters most to the Fed. While the chatter mostly surrounds signals like keeping rates low for a “considerable time” or the “significant slack” in the jobs market, the bulk of the Fed’s mandate is centered around controlling inflation.

That’s why this chart is so critical.

US 5 year breakeven inflation rate

5-year breakevens represent what the market thinks will be the average rate of inflation over the next 5 years. At the moment, it’s 1.53% compared to around 2% in the Summer. For 10-years expectations are at 1.91% compared to 2.20% in the Summer.

Falling inflation expectations are precisely what the Fed’s Bullard cited when he talked about delaying the end of the taper on Oct 16 and while 5-year breakevens have moved up 10 bps from then, it’s likely not enough.

How to trade it

The initial knee jerk will be related to 3 things:

1. If the Fed finishes the taper.

Chance of it happening: 95%. It would be a big surprise if the Fed didn’t finish the taper but Yellen doesn’t it will be because of inflation and it will spark a big drop in the US dollar (100 pips).

2. “Significant slack” in the labor market.

Chance the word ‘significant’ will be removed: 35%. This is overdue in my eyes with unemployment below 6% but the Fed is more focused on metrics of unemployment so there’s a good chance it stays. If it does, it’s a sell signal for the US dollar.

3. “Considerable time” – prior statement

The Committee continues to anticipate, based on its assessment of these factors, that it likely will be appropriate to maintain the current target range for the federal funds rate for a considerable time after the asset purchase program ends, especially if projected inflation continues to run below the Committee’s 2 percent longer-run goal, and provided that longer-term inflation expectations remain well anchored.

The chance of some of this changing if the Fed completes the taper is 100% but they could rearrange the wording to continue to indicate low rates.

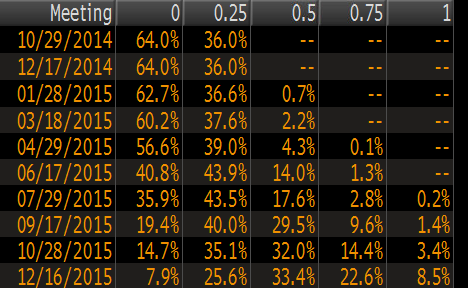

The Fed funds market is pricing about a 15% chance of rates higher than 0.25% at the June meeting and that rises to 40% by September. But note that a ‘hike’ is a bit of a challenging thing to deny because the current rate is 0-0.25% and a move to a flat 0.25% could be considered a hike (and it truth it would be with the effective Fed funds rate around 0.09%).

If the Fed takes out “considerable time” and signals a rate hike sooner, the US dollar will shoot higher.

Fed rate probabilities

Note: There is no press conference or dot chart after this meeting.