With post-FOMC moves I like to to wait for some confirmation (at least an hourly close) above a level before I really believe in any kind of break.

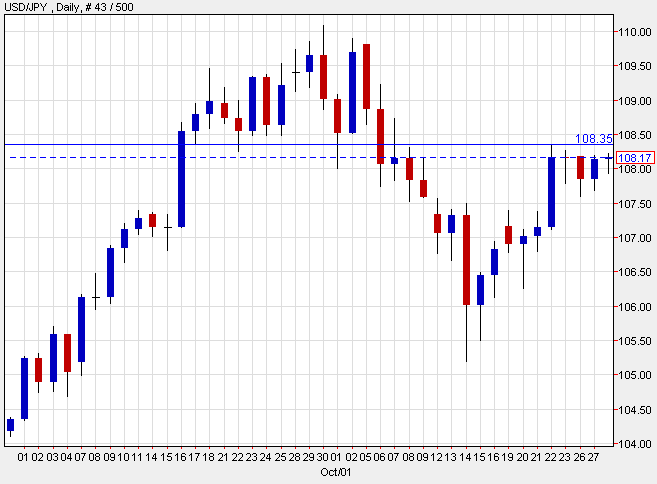

1. USD/JPY at 108.35.

That’s the October 22 high and a break above could pave the way back to 1.10.

USDJPY daily

2. GBP/USD to 1.6184.

The late-October high of 1.6184 capped yesterday’s rally. If the FOMC delivers something dovish, this will be an early level to watch. There’s an inverted head and shoulders on the cable chart that points to 1.6550 if it breaks.

cable daily

3. Gold – $1210 on the downside, $1245 on the upside.

Gold has been unusually quiet over the past two months but that could come to an end after the Fed ends QE. If the statement is hawkish, look for a push to the downside. There’s some support around $1220 with more at $1210; if the downside goes I think gold could be in for a something along the lines of the $150 fall like in the last two months of 2013. Above the 55-dma at $1245 and the bears may start to cover in a squeeze higher.

gold daily, e