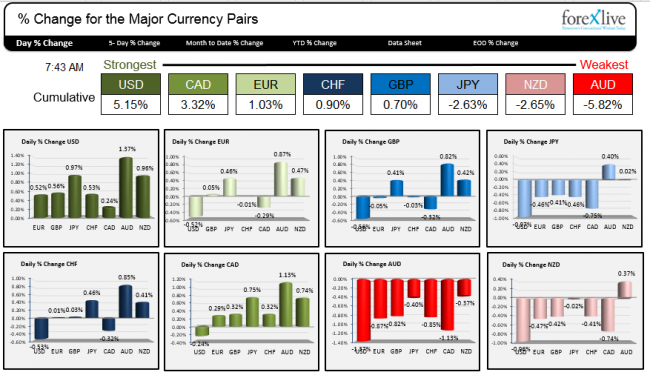

The US mid-term election results has helped the USD move higher in trading today. The greenback is strongest against the AUD and NZD. Both pairs have trended lower in trading today (see charts below). Each also found selling interest against MA resistance. The AUDUSD found sellers against the 100 hour MA (blue line in the chart below) while the NZD found sellers against the 200 hour MA (green line) after better than expected employment numbers sent the price higher. Traders who leaned against these risk defining levels were rewarded with a steady move lower today. The AUDUSD is trading at the lowest level since July 2010. The midpoint of the move up from the 2008 low to the 2011 high comes in at 0.85423..

AUDUSD and NZDUSD trended lower in trading today.

In addition to the weakness in the NZD and AUD, the JPY is also weak. BOJs Kuroda said he would do all he can to stimulate inflation.

Strongest and weakest currencies in trading today as NY traders enter for the day.

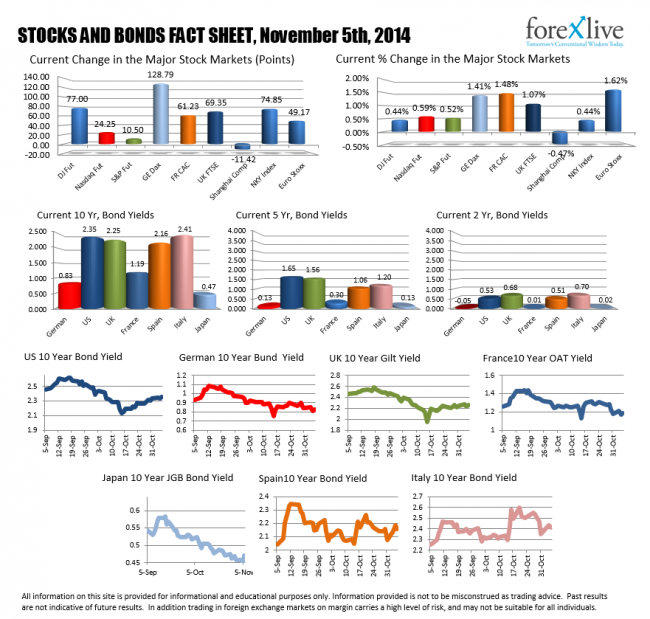

Stocks and Bonds

The US pre-market stock indices are higher on the back of the pro-business Republicans now controlling both Houses on Capitol Hill. The European stock market are also higher in trading today with the German Dax up 1.41%. Bond yields are up a few basis points in the US and Germany from this time yesterday.

A snapshot of the stocks and bonds

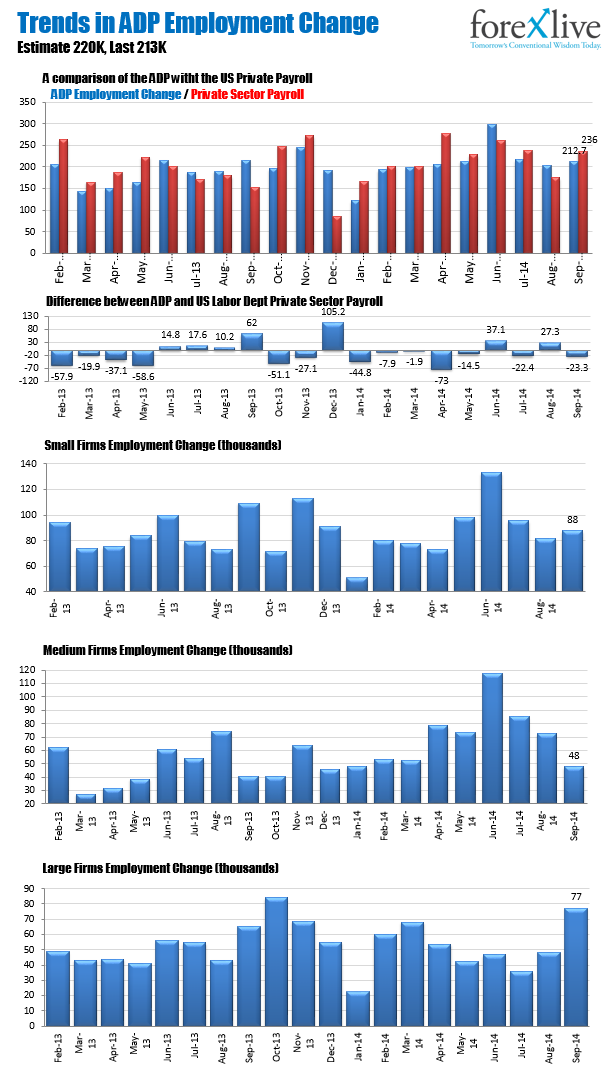

ADP Employment Change (8:15 am et) is expected to show a rise of 220K from 213K. The below infograph shows the trends. Markit Services PMI (est 57.1 vs 57.3 last) and Composite PMI (no est. Last 57.4), will be released at 9:45 AM ET.

Trends in the ADP Employment Report

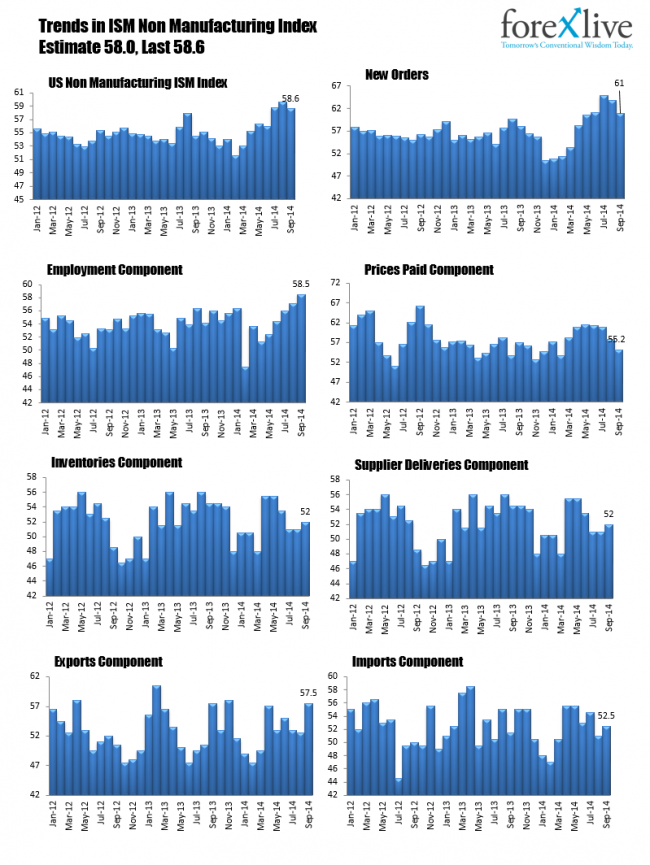

The ISM Non manufacturing composite index for October will be released at 10 AM ET. The Manufacturing index rose sharply to 59.0 from 56.1 last month. Below are the trends in the Non-Manufacturing Index.

Fed’s Kocherlakota speaks on Monetary Policy at 9:15 AM ET. Fed’s Lacker speaks at 9:30 AM ET. Later this evening, Bernanke speaks at an Investor Conference in Denver (at 6:45 PM ET)>

Good fortune with your trading today.