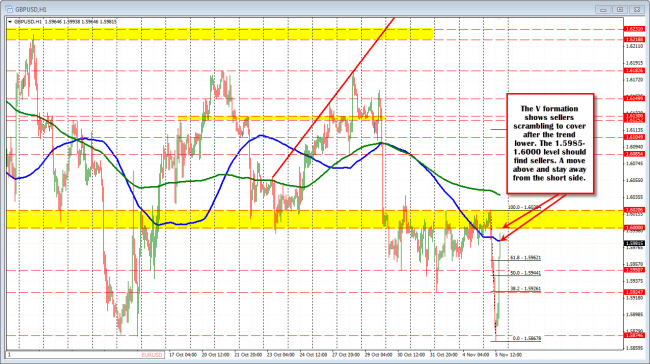

The GBPUSD pushed to new month and year lows (lowest level since November 2013), but the new low was only by 5 pips (1.5868 vs 1.5873) and the price started to rebound.

The better than expected ADP did not impress, and shorts have continued to cover with the price moving to and above the 50% retracement of the days trading range at the 1.5944 level and now above the 100 hour MA (blue line). The shorts are scrambling after what seemed to be a trend move lower today.

The price is in an area where there should be sellers including the aforementioned 100 hour MA and above that the 1.6000 level. If the price can hold this level there may be a trade rotation lower back toward the 1.5962 and if it can get below that level the 50% of the days range at the 1.5944 level. However, the visions of trending away from the 1.6000 level seemed to have taken another blow. So expect back and forth action (i.e., the low is in place) with support at the 1.5944 level now..

A move above 1.6000 level and shorts should stand aside. Trading type market with buyers and sellers likely bloodying each other for the time being.

GBPUSD squeezes higher. Tests 1.6000 level.