A no-nonsense preview of non-farm payrolls for November 7, 2014 that sticks to the numbers:

Release time is Friday at 8:30 am ET (1330 GMT):

- Median estimate 235K (225K private)

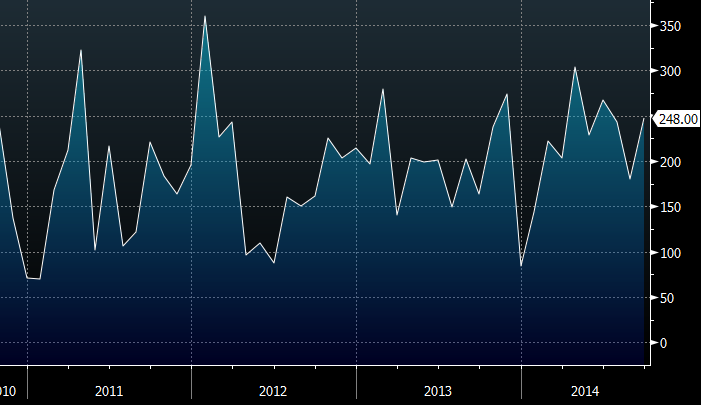

- Oct reading: 248K (best since June)

- High est 300K (Fathom Financial)

- Low est 195K (HSBC)

- Avg of estimates made after ADP/ISM-non: 245K

- Standard deviation: 23K

- NFP 6-month avg 248K

- Unemployment rate est. at 5.9% vs 5.9% prior

- Prior participation rate 62.7%

- ADP 230K vs 225K prior (220K exp)

- ISM August manufacturing employment 55.5 vs 54.6 prior (highest since 2006)

- ISM August non-manufacturing employment: 59.6 vs 58.5 prior (highest since 2005)

- Consumer Confidence jobs-hard-to-get: 29.1 vs 29.4 prior (lowest since 2008)

- Initial jobless claims 4-wk moving avg: 279K vs 295K at the time of the Sept jobs report

- Conference Board Help Wanted OnLine showed demand for hiring up 11.7K

- Aug Challenger job cuts: +11.9% y/y

- June JOLTS job openings: 4835K vs 4605K prior (highest since 2001)

After going through the numbers, the US jobs market is in better shape than it’s been in a long time. The question that the Fed’s mulling is: Where is the wage inflation. Today’s non-farm productivity report once again showed very weak wage inflation.

I looked at my favorite non-farm payrolls pre-indicator yesterday and I think there’s a good chance of an upside surprise and that’s borne out in the most-recent estimates.

non-farm payrolls net change

Even if the report is weak, I think it’s a chance to buy a US dollar dip because any worries about jobs will be short lived.

However, stay focused on average hourly earnings (exp +0.2%) and average weekly hours (exp 34.6). If those are soft, US dollar weakness could extend further.