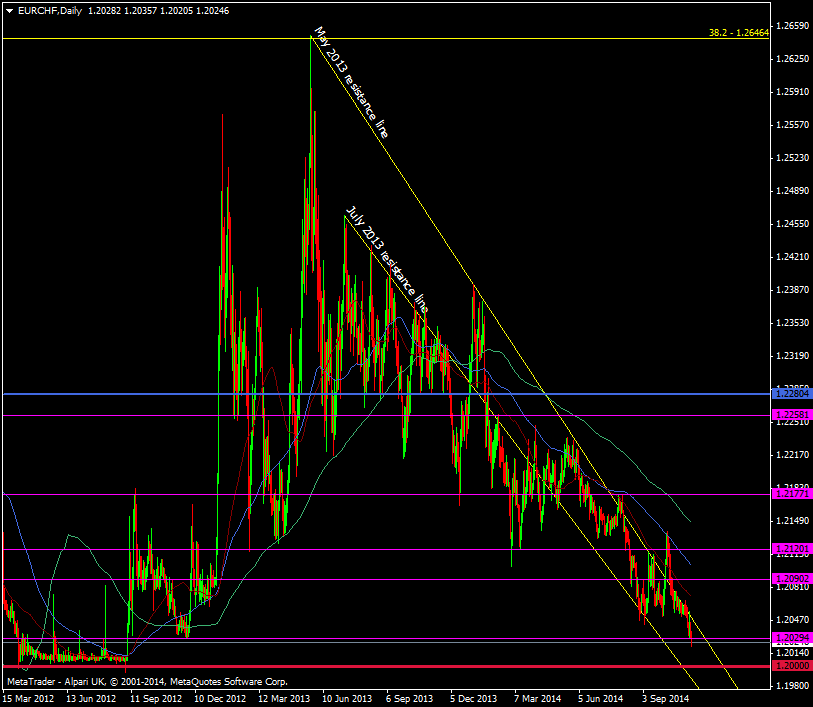

1.2021 trades the low today and we haven’t been this low since November 2012.

EUR/CHF Daily chart 10 11 2014

Lots of comments coming in about the move, as expected and the SNB is going to be watching carefully.

Recently they have been warning that a yes vote for the gold initiative would make a defence of the cap difficult and that’s partly the reason why EUR/CHF has softened. On the other side they have also been strong in saying they will defend the 1.20 level.

There’s many many longs who are going to be quaking right now and praying to the trading gods that the SNB step in but reader Repo has made the best comment so far saying that;

“The SNB is committed to defend the floor, not at 1.2025, nor 1.2005, but at 1.2000″

Dead right.

Mike and I had a good long discussion Friday about the Swiss franc and what could transpire. Mike put forward some good arguments why the peg might not survive. My main counter argument is that there is no reason why the market should take it on. I just don’t see the value.

While there are said to be billions in stops from 1.1950 through 1.1900, anyone wanting to target them has to overpower the SNB, who have most probably got unlimited credit lines open with nearly every major bank and institution. Let’s assume they do get overrun, and the stops get triggered, there would only be a finite time before the SNB re-establishes control, so whoever hits the stops is going to be on the bid, in size, close to but under 1.1900, and will have to get their shorts covered before the SNB takes over agian. At the most they may get between 50/100 pips.

That’s not bad work on a position of billions but is the risk/reward good enough? What if the market fails to take the SNB? The market will be trading 1.21 in quick time on a failure as the shorts cover and those stopped out also get back in. That’s one crowded trade for any big fish to take a share of. Again, I just don’t see the value.

If the SNB were the same side of the trade as the Bank of England when George Soros took them on then I wouldn’t be sitting here in long positions. They’re not and even if the gold vote goes against them they can still hit the print button to infinity.

I don’t rule out the cap breaking, it would be stupid for anyone trading it to do so. There is a lot on the line for the SNB both reputationally and fundamentally for the swiss economy and so I am putting a large dose of faith in them. Trading this pair has never been about the SNB first and foremost but about setting up the trade and money management as you would any other. The SNB has been a bonus in that it’s not often you get a central bank as a backstop.

Back in September I ran a poll asking if the SNB could defend the cap. The vote went 206 to 86 in favour of the SNB. Let’s have another one to see if that has changed at all.

Squeaky bum time at the SNB, can they hold the line?

Yes put your house on it

Yes but I'm less confident than I was

Time for the SNB to buy some new underwear