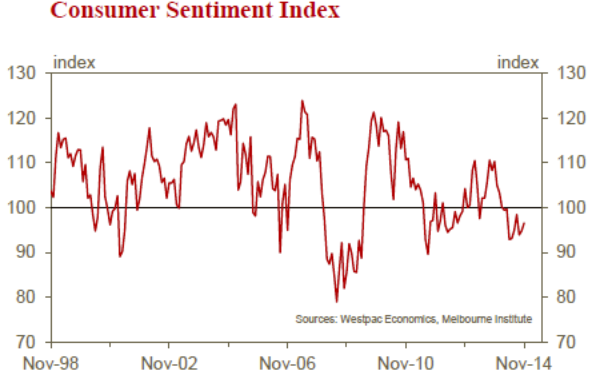

Westpac Consumer Confidence Index (s.a.) for November +1.9% m/m to 96.6

- prior was +0.9% to 94.8

Comments from Westpac (bolding mine):

- Unsurprising but still disappointing result

- Index is 12.5% below its level of a year ago and 3.6% below its level before the lead up period to the Commonwealth budget in May

- Now seen nine consecutive months where pessimists have outnumbered optimists … the longest run of pessimists outnumbering optimists since the Global Financial Crisis and before that the recession of the early 1990’s

- The November Consumer Sentiment Index is watched closely as a lead indicator for prospects for the Christmas selling season. In that regard the 0.8% fall in the component “good time to buy a major household item” is disappointing particularly given that this component is now down by 13% over the last year.

- There is further disturbing news on prospects for the Christmas season. Since 2007 we have asked the following question in November. “Do you think that you will spend less, about the same, or more on Christmas gifts compared to last year?” For this year 38% registered “less”; 50 %, “same” and 12% “more”. The net balance (more minus less) of minus 26% is the worst since 2008 (minus 34%) which was in direct response to the Global Financial Crisis.

- For most of this year Westpac has been of the view that rates would not be increased until August 2015. Critical to that view is a lift in consumer spending which in turn will encourage businesses to invest and employ. The Consumer Sentiment Index has lifted modestly from its post Budget lows but the pace of improvement has been very disappointing. Strengthening balance sheets and an improving world economy are likely to be key to further recovery in Consumer Sentiment. However, in the near term, prospects for a boost in consumer spending going into the end of the year are not encouraging.

–

Yesterday we got business confidence and conditions data from Australia.