On Sunday (early Monday depending on where you are) we get Japan’s Q3 GDP and Kenji Yoshii at Mizuho Securities says that the data may be the cue for dollar yen to test 118 and even 120. He also said that the market hasn’t fully priced in the potential snap elections and a delay in the next sales tax hike.

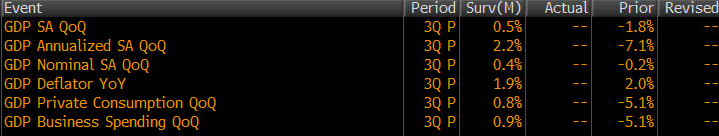

We’re looking for a return to growth this quarter after the sales tax slump last quarter and there’s going to be a lot of focus on the consumption and spending numbers to see if Japan has weathered the sales tax hike now. Here’s what’s on the card.

Japan Q3 GDP expectations

At the moment it’s hard to find a reason for the yen to rise on the data. If it’s good then 118/120 is a possibility. If it’s bad then any falls will be soaked up on expectations of further BOJ action to support the economy. Like yesterdays BOE inflation report, it’s 2 to 1 in favour that USD/JPY goes up.

Without stealing his thunder, Eamonn will have a more in depth preview