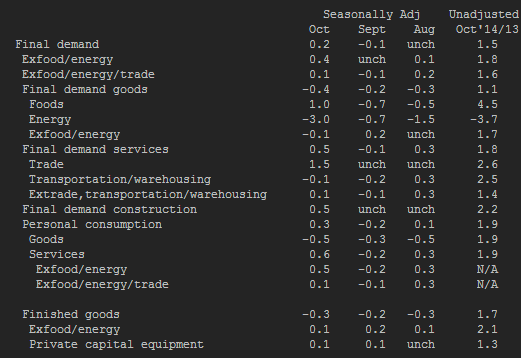

- Prior -0.1%

- 1.5% vs 1.3% exp y/y. Prior 1.6%

- Core 0.4% vs 0.1% exp m/m. Prior 0.0%

- 1.8% vs 1.5% exp y/y. Prior 1.6%

Not exactly screaming “lower prices” is it? Dollar gets a little lift to 116.66 but falls back to 116.57.

Goods was one of the bigger fallers in prices but that mostly came from lower energy prices as the “ex’s” highlight.

US PPI final demand 18 11 2014

There’s enough in the report to suggest that falling inflation fears may not be as scary as some imagine (Services highest since July 2013) . The market will need to see the trend start to decisively shift up before it jumps on board that theory though.

US PPI final demand core y/y 18 11 2014