This week will be remembered for three economic data points that were way out of line.

Here are the best explanations for what happened.

1. Japanese Q3 GDP

- Expected +2.2% q/q

- Actual -1.6% q/q

- Prior revised to -7.3% from -7.1%

- Miss: 7.6 standard deviations

Japanese GDP

This number put Japan in a quadruple-dip recession. It was so bad Prime Minister Abe called an election afterwards. Foreknowledge of the data might have even sparked another round of Bank of Japan quantitative easing.

It was the worst miss on a GDP forecast in memory and turned the economic conversation in Japan upside down.

One reason for the drop was an unusual private inventory adjustment but that means some upside for Q4. Another was the typhoon but the big one was the consumption tax. There is talk that consumer spending bottomed out in July and is beginning to recover.

But overall, it was a genuine miss and leaves the Japanese economy in a dismal spot.

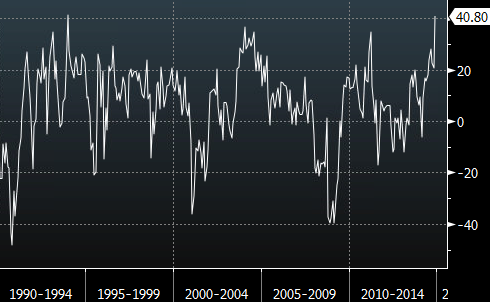

2. November Philly Fed

- Expected 18.5

- Actual 40.8

- Miss: 8.9 standard deviations

Philly Fed – 25 years

The Philly Fed is the first US regional manufacturing number of the month and the accompanying release didn’t even attempt to make sense of a jump to the highest since 1993.

In the market, there aren’t many believers. The US dollar faded after an initial pop.

It’s not the largest region and something localized could have been behind the move. The Markit survey of manufacturing nationally, released 15 minutes earlier was lower than the month before. Finally, the survey of six-month future expectations rose just 3 points and is well below the highs from earlier in the year.

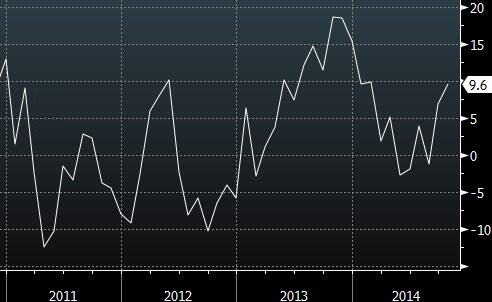

3. Oct Japanese exports

- Expected +4.5% y/y

- Actual +9.6% y/y

- Miss: 7.3 standard deviations

Japanese exports y-y

The aim of yen devaluation, stated or not, is to boost exports and this could be a sign of early success but economists are skeptical. Part of the strength is companies reporting and charging dollars, so it doesn’t represent a pickup in items exported but overall volumes were also up 4.7% y/y.

Global demand may be helping with volumes to Asia up 4.4% and sales to the US flattening out after a drop earlier in the year.

A final theory is that one-offs may have been a factor. in the last 10 days of October. Through 20 days of the month, exports were up 4.5% on year but by month-end, they were up 9.6%.