Brent is up $2 from today’s lows and WIT a smidge less after the PBOC look to stop the rot of a slowdown.

That’s been a breath of fresh air to oil which has been languishing around this months lows.

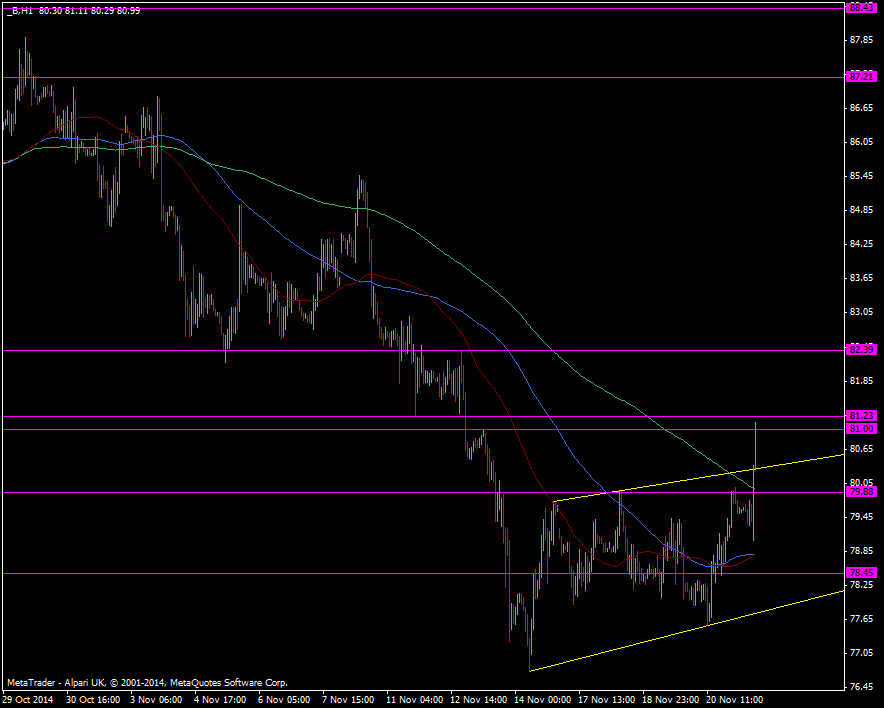

Brent has just broken above resistance at 81.00 after the move out of the weekly channel and there’s some minor resistance at 81.20/25

Brent crude oil H1 chart 21 11 2014

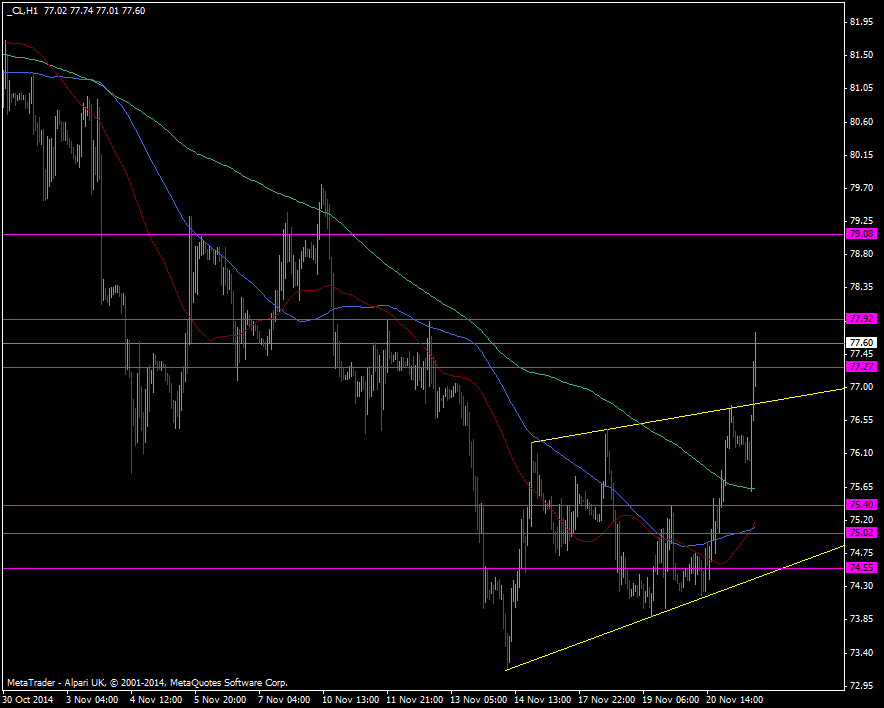

WTI has also made a similar breakout and has one eye on resistance around 78.00

WTI crude oil H1 chart 21 11 2014

I was hanging out for next week to scale in some longs, primarily to catch the rising expectations for production cuts at next week’s OPEC meeting. We’re also entering winter and with a big cold snap already hitting the US quite early, it’s going to add a premium to oil.

At the moment the bullish factors (Winter, OPEC, China) outweigh the bearish (Over supply, growth worries) so I’m not looking to fade any rallies either right now. I’m not keen on getting into longs on the last day of the week either but I’ll see how the prices unfold for the rest of the day and early next week.