The EURUSD fell in the first hour of trading today – falling to the 1.23607. The low for the year was at 1.23572.

EURUSD falls to the year lows, but can not get below.

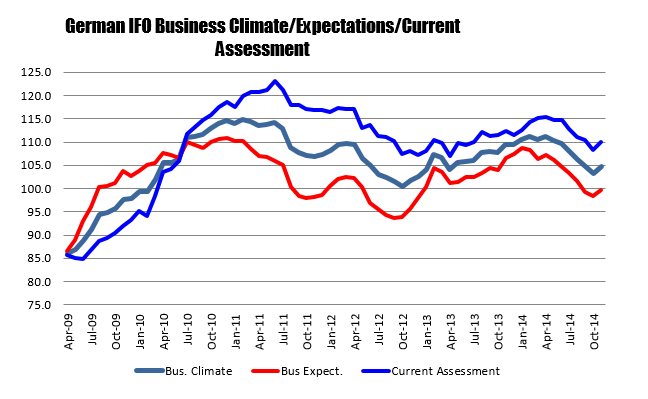

The inability to push below the year lows along with better than expected German IFO data helped to push the pair off the lows and reverse some of the sharp declines from Friday’s trade. The German data was higher and better than expectations as well but remains near low levels going back to 2012/2013 (see chart below)

The German IFO data rebounded in the current month

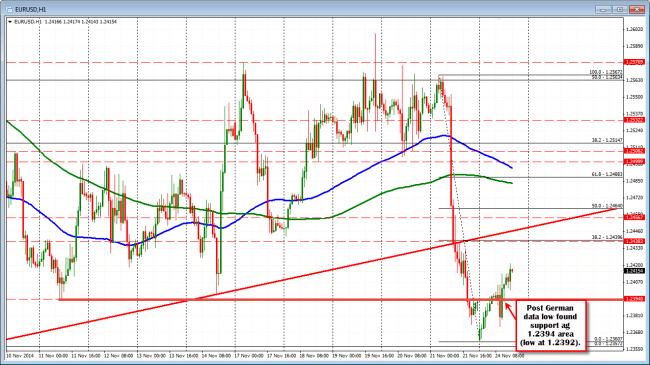

Looking at the hourly chart, the pair is back above the 1.2394 lows from last weeks trading. On Friday, the pair fell below this level and stayed below. Today, the bottom fishers and better data got the pair above the resistance area. Note that the post German data found support buyers against the level (the low came in at 1.2392 and rebounded – see chart below). So the fall has been slowed.

The EURUSD has corrected back above the 1.2394 area.

For today, the corrective buyers have some control. The next topside resistance comes in against the 1.24396 level which is the 38.2% of the move down from Friday. With the range for today only 60 pips, a correction toward that level is possible. I would expect sellers to use the level to sell.

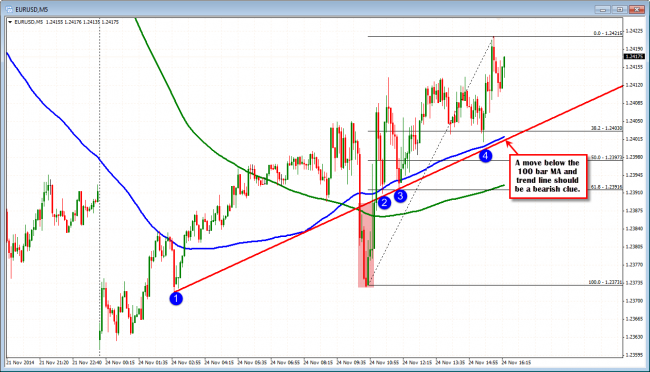

On the downside, the 5 minute chart shows the choppiness from the pre and post German IFO data but since the release, the price has found support against the 100 bar MA (blue line). Stay above and the buyers remain in control. Move below and this should be a clue the correction phase is over.

Overall, the bias should continue to the be down for the pair from a fundamental perspective. There will be corrections however. If technical targets can not be broken – like the year lows – there always is the chance for buyers to enter. However, I would still expect sellers on rallies as well.

Remember as well, we are in the Thanksgiving week for the US. Then Christmas will be approaching. I do not necessarily think the markets have to shut down, but liquidity conditions can be a bit lighter. That is a two edged sword. The lower liquidity can lead to stagnant markets, but it can also lead to wide swings as well. Be aware.

The EURUSD has been finding support against the trend line and 100 bar MA.