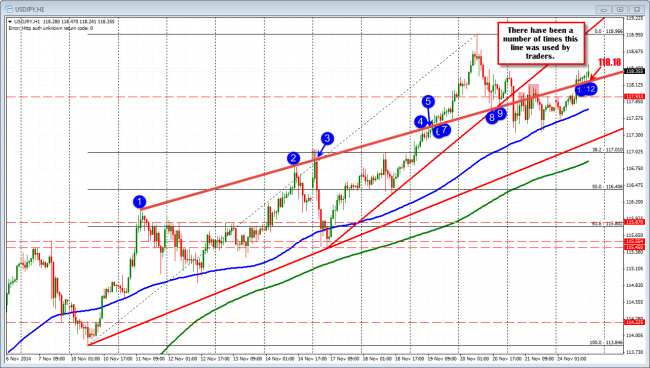

The USDJPY is trading back above a trend line that has alternated from resistance to support over the last few weeks (see blue circles in the chart below). The pair technically has also solidified the 100 hour MA (blue line in the chart below) as a key level to eye and lean against on dips. The buyers remain in control. The dips keep finding support buyers.

USDJPY has found support against the 118.18 level.

Going forward, watch the cutting trend line at the 118.18 level for support today. I know on Friday, the line was not the most helpful of technical levels, but Friday was more about the EURUSD then the USDJPY. What Friday (and today) did show technically for this pair, was that at the lows there was a willingness by the buyers to lean against the 100 hour MA (blue line in the chart above) as a risk defining area.

The inability to close below that MA, helps to confirm the bullishness for the pair, and the importance of this technical MA line in determining a bullish/bearish bias going forward from here. If the rally in the USDJPY is to end, a move to and through this MA (and staying below) will be needed. Until then, expect the dip buyers to lean against the level.

In the meantime, the closer support is the 118.18 level (risk level for buyers today).