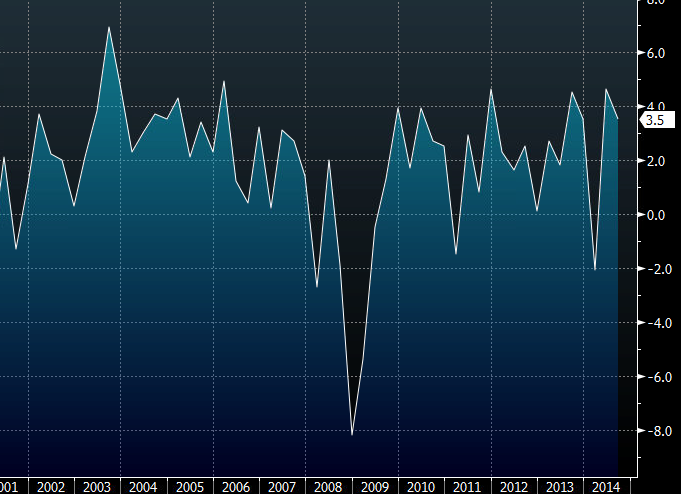

The second reading of US third quarter GDP will be released on Tuesday at 8:30 am ET (1330 GMT) and will likely be revised lower.

The consensus estimate is that it will be trimmed to 3.3% from 3.5%. A slowdown that would lower growth so far this year to a 2.03% pace, hardly the kind of acceleration that could carry worldwide growth.

US GDP q-q annualized

But there are a broad range of estimates — from 2.8% to 3.8% — so the story could change quickly.

Normally, the market doesn’t overreact to the second reading of GDP because it’s already almost two months in the rearview mirror. Lately, the market has been more-sensitive to economic data so the US dollar moves could be more prominent, especially with little else on the calendar.

If GDP is out of line with estimates, it’s not necessarily good or bad news because something like inventories could simply shift growth from one quarter to another so keep a close eye on the details.

When Q3 GDP was first released it was stronger than the 3.0% expected but the two major drivers were government spending and trade, something the market didn’t like. Afterwards, the US dollar quickly reversed.

Estimates are lower because economists generally believe that net exports will be revised lower.

USDJPY after Oct 30 US Q3 GDP report

One spot in particular to watch is personal consumption. In the initial report it rose 1.8% compared to 2.5% in Q2 but even if it’s not revised higher, the market will be looking for a strong consumer in Q4 because of lower gasoline prices.

Don’t expect a lasting impact from the GDP report in markets; traders will quickly shift their focus to Friday’s durable goods report after the data.