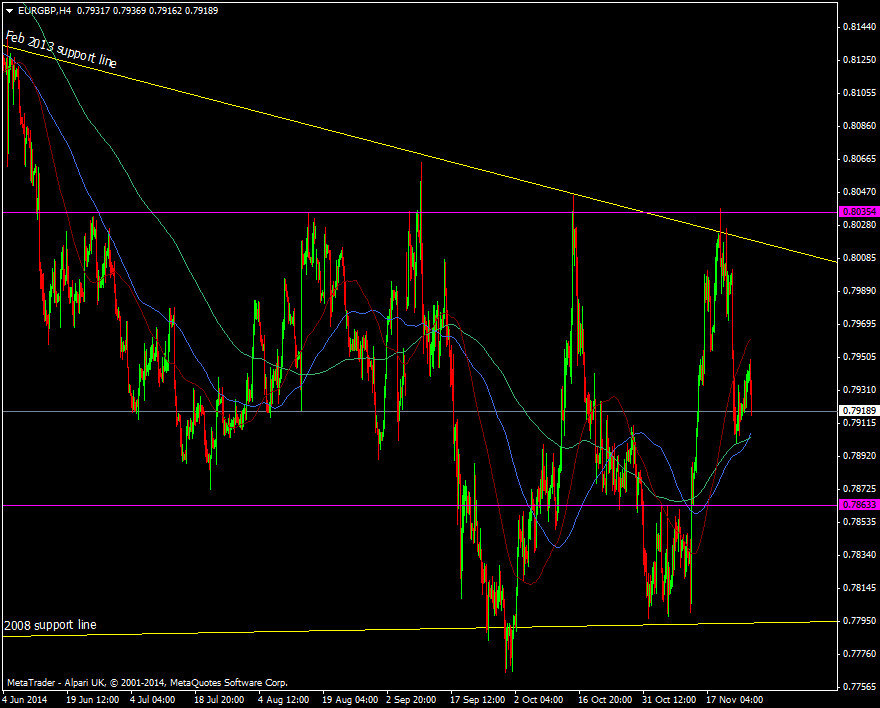

Another pair moving between the goalposts with 0.8000/40 on one side and 0.7800 on the other. There’s always natural S&R at the big figures so 0.7900 is likely to see decent support and it has the addition of the 100 & 200 h4 ma’s to keep it company.

EUR/GBP H4 chart 26 11 2014

This is my ultimate pair to trade the UK economy and interest rates. I’m already short and toying with the idea of adding to the position ahead of the ECB next week. My only real concern longer term is that we see some sort of recovery in Europe in the New Year and get a huge relief rally. Such an event will be double bubble for buyers as it will mean that the current measures are working and that QE will be pushed back or taken off the table altogether. That scenario still won’t put Europe anywhere near an interest rate rise but it will have the shorts running to the hills.

In the meantime though, the range is there to play short term and there’s more than a few pips to be made by the jobbers.

I also better add that due to the US holiday we may start to see some earlier end of month flows going through. With the UK paying it’s pound of flesh to Europe sometime in the next couple of days, the lighter liquidity might mean larger moves than normal. It shouldn’t really effect EUR/GBP but it might be magnified in the same dollar pairs.