The GBPUSD has pushed back higher in trading today. Better Markit PMI data, an Autumn Speech by Chancellor of the Exchequer George Osborne did not shock (see Ryan’s synopsis here) are contributing factors.

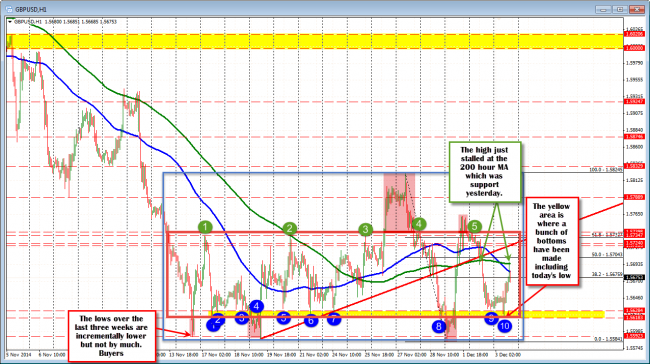

The GBPUSD found sellers against the 200 hour MA and support at a familiar low level area.

So what are the technicals telling us today?

From a technical perspective, the price held against what has been a bounce level over the last few weeks of trading at the 1.5618-28 area (see VIDEO from yesterday talking about this level “Technical analysis: 5 currencies — plus gold — in 6 minutes (VIDEO)” )

That hold was the bullish play in trading today. Traders who bought against this support area had the trade of the day from that perspective.

The bearish play so far, was that the peak off of the ADP report. The GBPUSD found sellers/profit takers against the 200 hour MA (green line in the chart above). Yesterday, the price initially bottomed around this MA level. When it broke below, it did it with increased downside momentum.

If the price is to go higher today, this level needs to be broken.

Until then we still remain in a bottom part (below MAs – blue and green lines in chart) of what is a consolidation range. That consolidation range has an inside value area defined by 1.56183 to 1.5739 (see red box in the chart above) and a larger outside extreme area where the price ventured (above and below) but failed (note red areas).

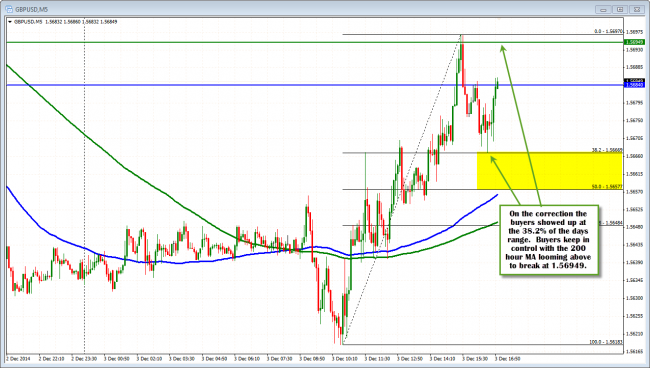

With the hourly chart somewhat ambiguous, is the intraday chart showing any risk defining technical clues?

Drilling down into the 5 minute chart for clues, the correction off the 200 hour MA, just held the 38.2% retracement. If the price can remain above this retracement level (it was a high earlier today as well), the buyers keep the edge. Stay above and look for another run at the 200 hour MA with stops on a break above. Move below and there should be a test of the 50% and 100 bar MA (blue line). It is time for the buyers to prove, they want more. We will see.

The GBPUSD held the 38.2% retracement. Buyers remain in control.