From Jon Hilsenrath in the Wall Street Journal today: Fed Simulations Call for Rate Hikes Soon. Bolding mine …

According to research conducted by senior Federal Reserve economists:

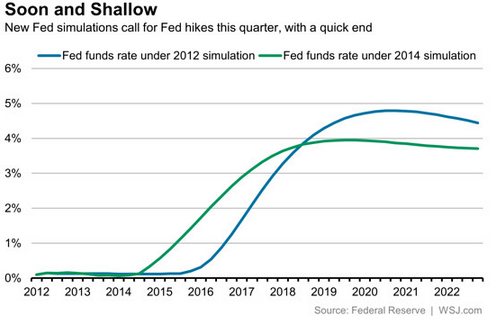

- Finds the best time to start lifting the fed funds rate from near zero is right now, in the fourth quarter of 2014

- increases to 1.4% by Q4 2015

- 2.6% by the Q4 2016 and 3.5% by the end of 2017

- Looking out past 2020, the simulations never result in short-term rates above 4%

Says Hilsenrath :

- These simulations are noteworthy in part because Fed Chairwoman Janet Yellen pays attention to them. She highlighted earlier versions of optimal control exercises in speeches in 2012, citing the work as evidence the Fed should take its time raising rates.

BUT …

- Ms. Yellen, in her 2012 speeches, warned it would be “imprudent” to put too much weight on these simulation exercises, a view seconded by the Fed researchers, who say the models should be treated with a “high degree of caution” as a guide to actual interest rate policy.