Forex news for December 5, 2014:

- November 2014 US non-farm payrolls 321k vs 230k exp

- Unemployment rate 5.8% vs 5.8% exp.

- Canadian November employment -10.7K vs +5.0K expected

- Canadian trade balance +0.1B vs +0.2B exp

- BOC’s Poloz sees larger drag from falling Canadian oil prices

- US Oct factory orders -0.7% vs 0.0% expected

- Capital goods orders non-defense, ex-air revised to -1.6% from -1.3%

- ECB’s Visco says low inflation may weigh on indebted nations

- ECB’s Coene says continuously low inflation is as bad as deflation

- Fed’s Mester expects to raise interest rates sometime in 2015

- Italy sovereign rating cut to BBB- from BBB by S&P

- S&P raises Ireland’s credit rating to “A” from “A-“

- Mitt Romney gearing up for third run at Presidency

- Italy’s Padoan says EU needs a single economic policy

- Zhou Yongkang becomes highest-ranked CPC member arrested

- USD/JPY was the trade of the week

- S&P 500 up 3 points to 2075

- Gold down $15 to $1190

- US 10-year yields up 7 bps to 2.30%

- WTI crude down $1.13 to $65.68

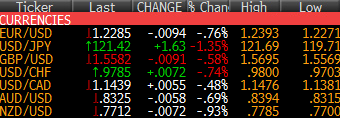

- USD leads on day, JPY lags

The non-farm payrolls report was unambiguously strong and the US dollar moved unambiguously higher. There were only two ways to make money in FX during US trading — buying the US dollar, or buying US dollar dips.

There was time to get in on the initial move as traders pawed through the report and tried to find some negatives but they generally came up empty and the dollar rallied nearly a full cent right across the board.

It got interesting from there with pairs making almost a perfect 50% retracement of the initial moves before rallying to fresh extremes.

In particular, cable was feeling some pressure. After the first 70-pip decline to 1.5620 it bounced 30 pips and then fell as low as 1.5569. Even late in the day it made a fresh low in a sign that no one wanted to step in front of USD strength.

USD/CAD was a special case but not as straight forward as you might guess. Despite weak Canadian employment, the full-time jobs reading was good and the strength in the US will filter across the border and that’s good news for CAD on the crosses. Technically, the pair is also facing sellers at 1.15 and that kept a lid on the pair.

The euro didn’t have much to digest from ECB comments and it made a solid stand just below yesterday’s pre-ECB low of 1.2280 but it finishes near the lows of the day and looks precarious, especially with the downgrades still coming.