After the “will it – won’t it” action around 120 yesterday, the break was finally confirmed as we powered through the level in Asia and early Europe to a new high of 120.45.

Where’s it going to stop is the question?

USD/JPY Monthly chart 05 12 2014

There’s quite a gap from here until the next strong tech levels with the first being the April 1990 trendline resistance at 123.08. From there we have the old April 1995 support line which joins the June 2007 high around 124.00/14. The July 2007 high at 123.67 can be added to the mix too.

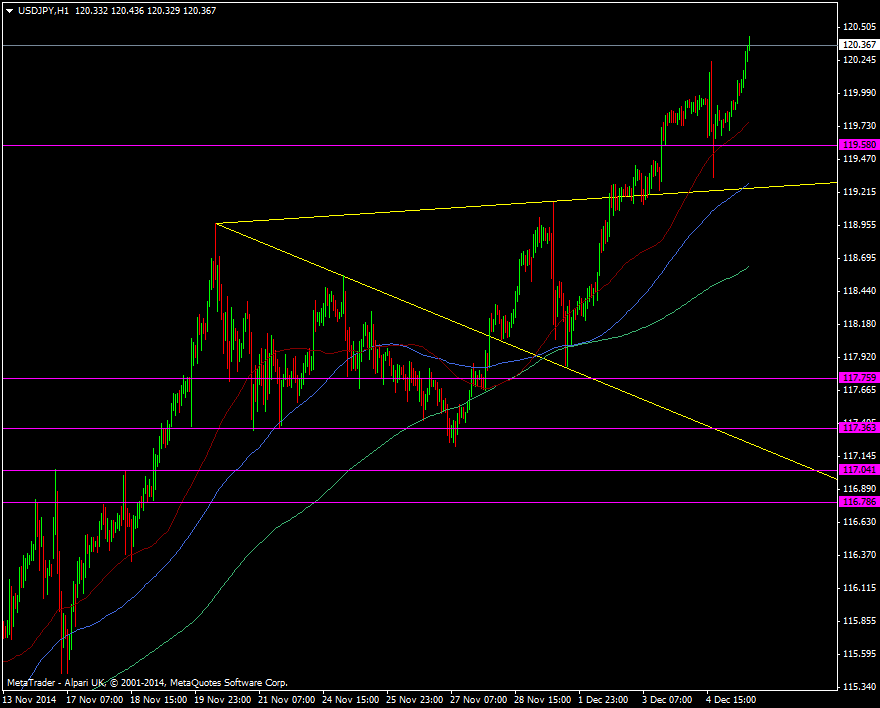

Coming intraday, 120 is going to be the main focus for support followed by 119.70/60 then stronger at 119.25/30

USD/JPY H1 chart 05 12 2014

So what can halt the unstoppable machine?

The higher we go the more we’re likely to hear from US and Japanese firms that the moves are becoming excessive. We’ve already heard some murmurings and should be on guard that we hear more. The Fed may also start to raise their voices about the moves affecting the economy too. Again, we’ve had mild reference recently but the higher we go the louder they may become.

What can drive us higher?

The market is still not really pricing in rate rises and the fear of falling inflation is keeping those expectations in check. This is something that can turn fairly quickly if the data improves and inflation holds up over the next couple of months. If it does and rate expectations get brought forward then we’ll get another kick up.

On balance the force is still very much with longs but this has been an incredible run in a relatively short space of time and that needs to remembered when judging further moves.

With the NFP up later we know that recently a good number has brought not much more than a shrug from the dollar and that may be the case again. If the number is weaker it won;t destroy the trend but may give a good dip buying opportunity.

For those that are itching to catch a short then a run up to the tech around 123/124 looks to be a good place to try, and one I’m going to be looking at myself.