Citi are making a case for a bounce in oil

- Prior estimates show +700k investor positions (futs & ops) since summer have been reduced two thirds to 220k

- Move lower has been an “unprecedented speculative sell off”

- Oil now exposed to short covering on a geopolitical risk event or OPEC production cut

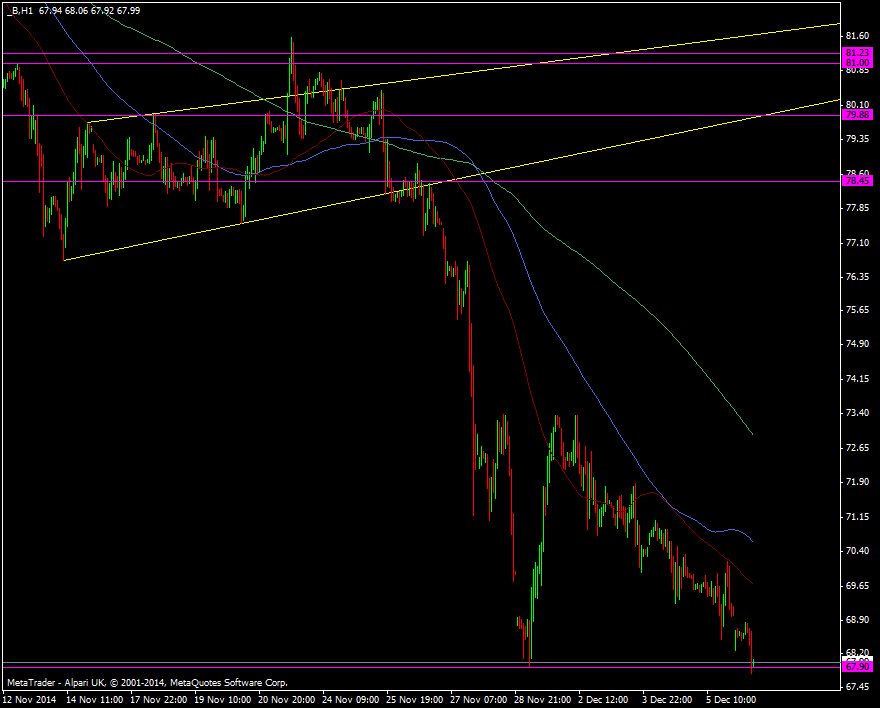

At the moment Brent is just about holding the November low and it’s an area I’ve been monitoring for signs of a bounce.

Brent crude oil h1 08 12 2014

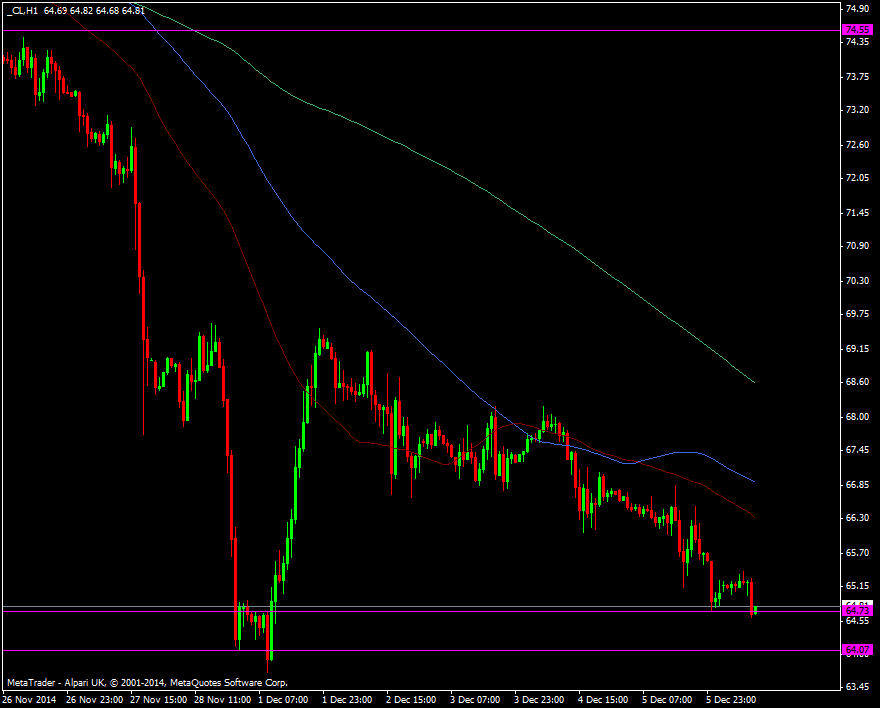

WTI is also not far off the late Dec/early Jan low

WTI crude oil H1 chart 08 12 2014

The level here coincides with the Feb & May 2010 lows so it looks a fairly strong level. I’m not willing to call a bottom in oil here but on a technical basis it looks good for a long with a fairly tight stop.