Are you in EUR/USD shorts?

Worried about a short squeeze?

Can’t wait for ECB QE?

Scared you might lose your hard earned cash to a tape bomb?

Fear not, dial 0800-G-R-E-E-C-E and forget all your worries

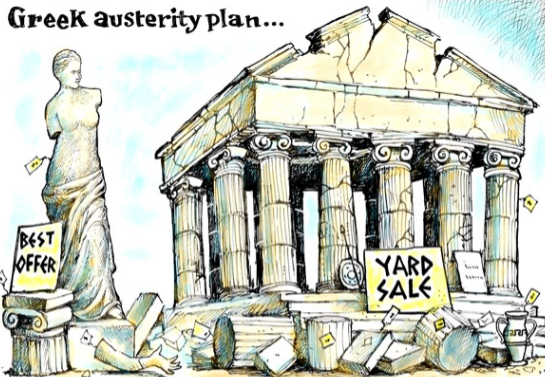

That’s right folks, Greece is back in the news (not that they’re ever far away from it). Hot off the heels of agreeing an extension to the bailout and talks, that should have been concluded by year end, PM Samaras has called a snap election for the presidential post.

He’s said to be short the 180 votes needed to elect a new president as his party and coalition only have around 155. If he fails to find the numbers needed to win then he will be forced to call a snap general election, in which the opposition Syriza party has a sizeable lead in the polls. If the opposition gets in it could really spell trouble for Greece as they are very much against the bailout and want to renegotiate the debt with the Troika.

A party from Syriza travelled to London two weeks ago to discuss their plans with banks and financial institutions, should they win an election. The FT reported that the details didn’t go down well, with one person saying that the programme was”worse than communism” and “total chaos”.

Samaras has called the first part of the election for Dec 17th. Then there are two more rounds Dec 23rd and 29th. At the moment there have been no candidates put forward.

On one hand we don’t really know whether Samaras will find the extra 25 seats needed easy to come by, after he has discussions with smaller parties, but the uncertainty of him calling a general election may weigh on markets. Greek bonds have blown out on the news and are up 43bp to 7.67% but the euro seems to be ignoring the risk right now. That could all change if he loses the first round which will increase the pressure on the following votes.

Greece is still the basket case but it’s been shoved out of the way and into dark corner for a while now. This could be the time it comes back into the limelight with a bang.

Greece’s Samaras hoping to call in some favours to avoid Greek Crisis 3.0

The market isn’t sticking around to wait-and-see: Greek stocks are down 11% and 10-year yields are up 58 basis points to 7.82%.