The ACCI-Westpac Survey of Industrial Trends is, according to Westpac, the longest running business survey in Australia

It “provides a timely update on the manufacturing sector and insights into economy-wide trends”

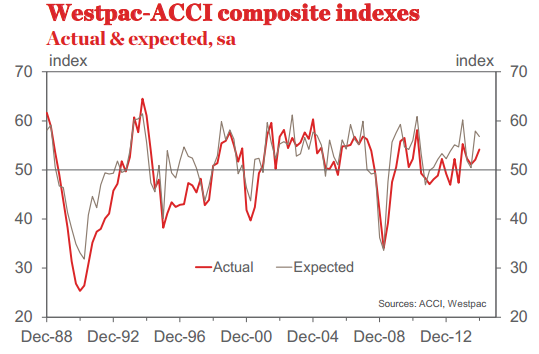

Westpac-ACCI Actual Composite rose in the December quarter to 54.2, up 2.1pts on September

- This is the fifth consecutive reading in the expansionary zone

- Suggests that the trend improvement in conditions that emerged in late 2013 may have resumed, after a lull mid-year associated with the tough Federal budget

- The strengthening of the Composite index is centred on a lift in new orders and in output, as well as overtime, but not employment

- Manufacturing is benefitting from rising building activity and the beginnings of a lift in service sector investment

- The cycle remains relatively modest

- Consumer spending is below trend, mining investment is turning down sharply and global fragilities persist

More:

- The Expected Composite Index was at 56.8, having rebounded by 7.5pts to 57.9 in the September quarter

- A net 4% of firms expect new orders to increase

- A net 4% expect output to expand in the next three months, on the back of this strong outcome at the end of 2014

- Net 27% (up from 15%) expect the general business environment to strengthen over the next six months

- Net 23% of businesses are expecting profits to increase

- Central to improved profitability is the strengthening of turnover

- Pricing power was absent at the end of 2014, with a net 2% of firms reporting a decline in selling prices

- The survey indicates that the lift in orders and output has absorbed some of the sector’s spare capacity

- There are tentative signs that investment by the sector is nearing a turning point

- A net 14% of firms expect to increase equipment spending in the next 12 months, the strongest reading since 2011

- The improvement, to date, is centred on fewer firms looking to reduce investment

- On jobs, the survey’s Labour Market composite has trended somewhat higher over the past year, to 50.1, pointing to a further gradual improvement in economy-wide jobs growth over the coming six months. The Difficulty of Finding Labour question suggests a little less slack in the labour market relative to a year ago

–

Some positive signs in this survey … but tentative at best. Still, some better news on the economy, even if tempered somewhat, is welcome.