If you asked me that question after non-farm payrolls, I would have said there’s a 90% chance it would be removed but now I think it’s closer to a 50-50 decision.

Looking at Fed fund futures, the market is pricing in a 68.8% chance rates will be at 0.00% or 0.25% in June.

Interestingly, the market now only sees a 25% chance rates will be at 0.50% at that meeting, down 7 percentage points since Monday in a sign traders are getting cold feet.

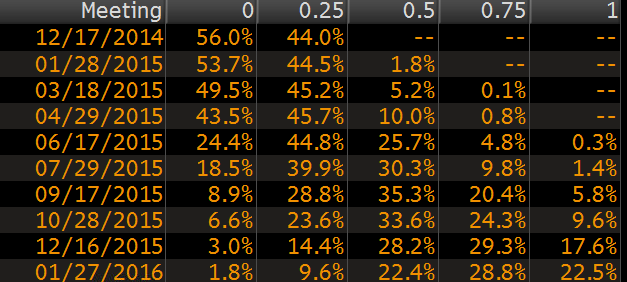

Fed funds implied probabilities

One problem is that right now, the Fed is in a range of 0.00% to 0.25% so there’s an argument if a move to 0.25% is really a rate hike. In the market, the effective Fed funds rate is 0.12% so I’d argue it’s like a half-hike but others are saying it’s not a real hike until the Fed gets to 0.50%. There is some confusion there.

What’s less confusing is 0.50% and that level is a 55/45 probability by the Sept 2015 meeting so that’s a more accurate reflection of where the market thinks the Fed will be.

On the weekend, Hilsenrath was out with his speculation the Fed could drop the commitment to keep rates low for a ‘considerable time’ and replace it with something like ‘the Fed will be patient’ on raising rates.

Rather than listening to Hilsenrath, I think Atlanta Fed President Dennis Lockhart should be the talking point. I urge you to read his latest speech, it’s light and short. He’s wildly underestimated but all his comments later prove to be in-line with the consensus of the FOMC. He was right about leaving ‘considerable time’ in the Oct statement. He said:

“I think patience regarding timing liftoff and a cautious bias regarding the subsequent pace of rate moves is a sensible approach to policy.”

Atlanta Fed President Lockhart

That might not mean ‘considerable time’ is replaced by ‘patience’. It might simply be added to it. In the speech, Lockhart sounded dead scared of hiking and then having to reverse course later.

I think it will be a few months before we can be sure the essential trends are solid and the economy is ready for a momentous shift of policy.

It’s natural for us policymakers, business leaders like you, and the public in general to be eager to get to policy normalization. Who does not want things to move closer to a long-run normal? But I think the FOMC must do its best to avoid having to reverse course because, as it could turn out, we moved too early.

The Fed can leave in ‘considerable time’ and also add it will be patient with subsequent hikes. I think what’s clear is that the Fed doesn’t want to be boxed in to a June hike and I think simply removing ‘considerable time’ would do that.