Although much has been made of the windfall from the decline in the price of oil to consumers (outside the oil producing countries that is), the gains from those declines, were hurt by the fall in global stocks this week.

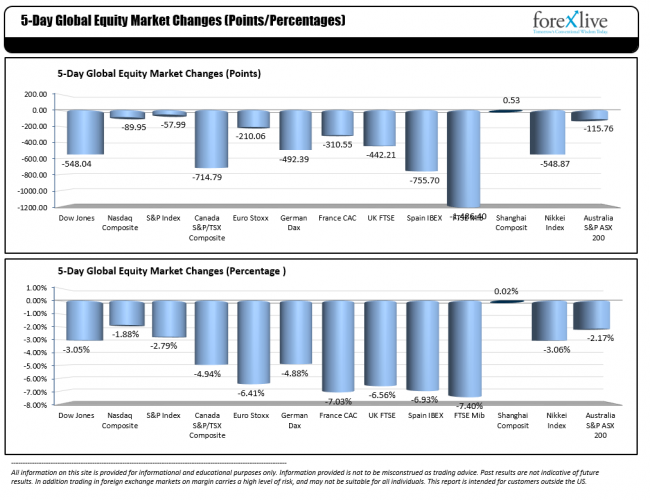

The major global equities markets this week (with an hour left in the US session), is certainly NOT something to be proud of. The FTSE MIB is the weakest performer for the week with a whooping 7.4% decline. This was the largest weekly decline since November 25, 2011. The French CAC performed nearly as poorly, falling by -7.03% (lowest since September 23rd 2011) while the Euro Stoxx Index fell 6.41% (largest week drop since August 5, 2011 ).

The change in the major global stock markets for the week of December 8-12

In the US the Dow shed -3.05%, the S&P fell 2.79% and the Nasdaq fell by 1.88%. For the Dow, the decline was the second largest weekly decline for 2014. The largest percentage decline was the January 24th week, when the Dow fell by 3.52%. The S&P decline was also the 2nd largest week fall (Oct 10 week saw the index fall by -3.14%). The Nasdaq fall was the 6th largest weekly decline in 2014.

Although oil prices helped to put money in consumers prices, the fall in equities, took money right out..

I guess things could be worse, the Athens ASE Index plummeted by -20.18% and is down over 28% this year.