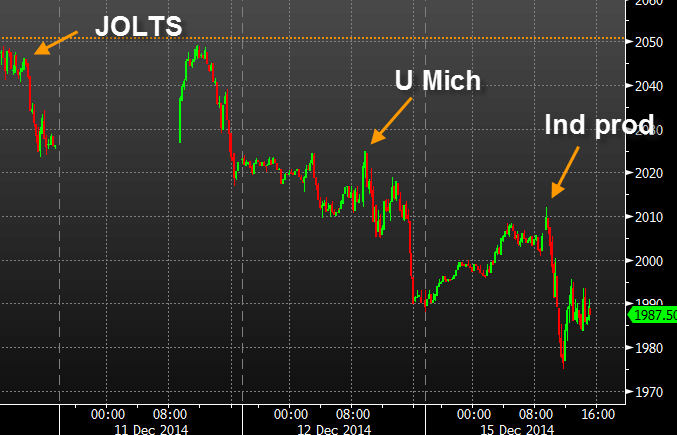

For the past two trading days, the high in the stock market came on the kneejerk following good economic data and then markets plunged.

The peak in the S&P 500 (and USD/JPY) today was immediately after strong industrial production numbers. On Friday, U Mich consumer sentiment hit an 8-year high and it was followed by a 35 point drop in the S&P 500. Last week, the market declined despite great JOLTS numbers and even a great retail sales report last week couldn’t sustain a stock market rally.

There are times when good news is bad news for markets. Those times are often when the Fed is thinking about raising rates.

My take is that it’s a razon thin decision about whether or not the Fed will hike and the data in JOLTS, retail sales, U Mich and industrial production may have tipped the balances — or at least that’s what the market is scared of.

S&P 500 three day

We will get two more chances to test that theory.

On Tuesday, housing starts are on the calendar then on the Wednesday morning of the Fed decision CPI data is for November is due.