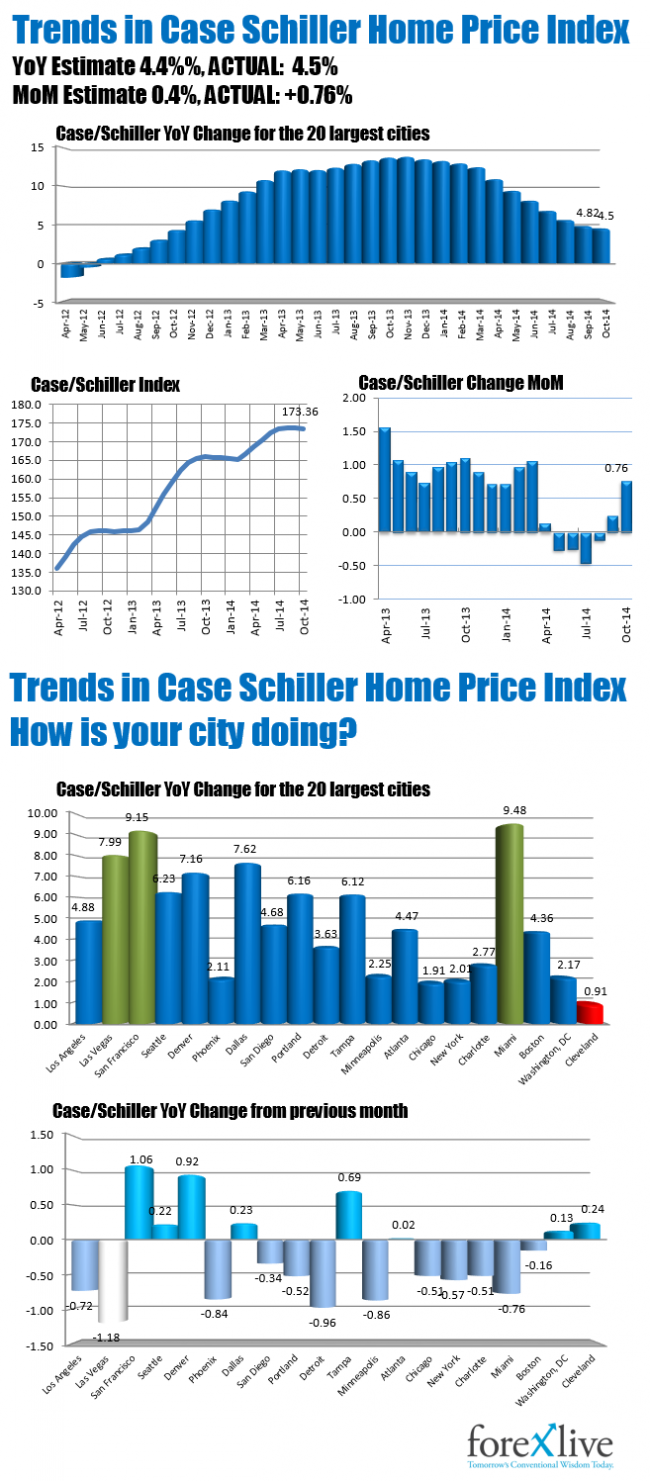

The Case Schiller home price trends continue to inch lower on a YoY basis, but the MoM change rose by the most since March of 2014. Housing had a nice move into the end of 2013 and now that trend has slowed. With the plunge from 2008, lenders are simply more conservative with their lending. You have to think that those that value houses are also more conservative in their valuations for loans. Add to that stagnant wage growth and you should get a housing market that is more steady overall. That is what we are seeing in this series.

Rates have been so low for so long, it has limited impact now (or so it seems). If mortgage rates do increase, that could be an issue going forward of course as the affordability declines.

Having said that, there will be pockets of strength. San Francisco makes sense. Wages are likely not stagnant there, but it could be getting too frothy as well. Las Vegas is still up large YoY but the YoY decline from last month (was up 9.16% last month) shows some slowing of the trend is starting to take hold. Miami is Miami. It is sunny. The baby boomers are moving and it was hammered in the slowdown. So strength is showing up there.

Below are the trends in the indices and a look at the winners and the losers (from a city by city standpoint).

Trends in housing from Case Schiller.