Japan was the focus of my third look at 2014 a year ago and whether Abenomics would live up to expectations.

Japan in 2014: Godzilla or Godzuki?

Here’s the highlights of what I was looking for;

Would the Japanese NISA saving scheme see the population using their hoards of cash savings to pile into investments?

So far there’s been very limited take up of the saving plan with less than 10% of the population enrolling in it. Compare this to the UK where similar schemes are held by 36% of the country. According to the FT around 50% of NISA accounts are dormant and 6-% of those are held by people over 60, meaning the younger generation are not interested. With the first anniversary of the NISA approaching, Abe is already looking at raising the annual limit to ¥1.2m from ¥1.0m in 2016 and introducing a Junior NISA for under 19’s as part of his next batch of stimulus measures.

As it is the scheme is currently a dud and Japanese investors have once again been net sellers of equities and were said to use the recent Nikkei jump through 18000 to take a lot of profit from long term holdings off the table.

After over 20 years of stagnating would Japanese firms throw caution to the wind?

Another tick in the ‘could do better’ column for this one. As we roll out of 2014 Abe is still trying to dangle the tax cut carrot in front of Japanese businesses just to get wages rising to help his inflation cause.

How choppy the seas would be after the sales tax hike and would it spur the BOJ into action?

Japan found the waters a bit more choppy than they were expecting after the tax hike and so much so that they knocked back the next hike and it caused the BOJ to step in with a surprise extra stimulus move in October. The market may have gotten a little complacent with BOJ sitting on their hands this year but they are back on BOJ watch once more as we head into 2015

Overall Japan is probably only fractionally better off than it was at the start of 2014 and Abe is beginning to find it tough to get the economy moving. Without the US finally showing some signs of life in the economy (most particularly with jobs), it’s hard to find a reason why USD/JPY would have pushed higher this year. As it was we saw 6/7 months of sideways movement before the US fundamentals drove it up. Abe may have won a stay of execution with the confidence vote but he still has a very long road ahead of him.

My final look at 2014 was a tongue in cheek look at China and their attempts at world domination.

China to take over the world by stealth

Work continues on making the yuan more mainstream with a raft of countries signing up to be trading centres. Slowly but surely the doors are opening.

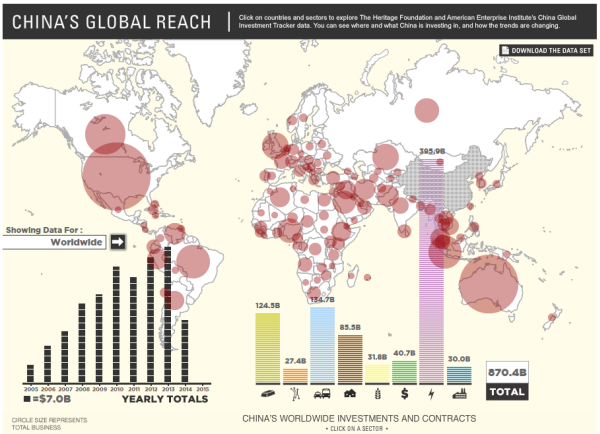

2013 showed a record spend by China abroad but that’s halved in 2014 according to the Heritage Foundation’s China global reach study.

Using the interactive map Australia has seen Chinese spending drop markedly and goes a long way to explaining the fall in the currency. Take Chinese money out of the equation and you can be left with a big hole to fall into.

The shady side of China loomed large with shadow banking and blows ups in company debt still at the forefront of thoughts in 2014. The expected slowdown looks to be finally playing out in the data but we’re still hearing from the powers that be that growth will be in expected ranges. At the moment those calls are looking shaky and China will be a big focus in 2015 as the global economy struggles to take off. In the banking world, worries still circulate that there’s a debt house of cards waiting to fall.

Global domination may still be on the agenda but it might take them a bit longer than first thought. That said the yuan could start coming to the fore next year and could even start it’s challenge on the dollar as reserve currency.

Lots to look forward to in 2015 as there is every year and that’s the great thing about trading. You know there’s always something to do and something surprising waiting just around the corner. I’ll be gathering some thoughts for the New Year and pitching what I’ll be looking for in 2015.

I hope you all had a great 2014 both personally and in the trading world and I wish you a cracking one in 2015