It’s not just traders who don’t like the euro, central banks have been unloading too.

The IMF quietly released Q3 FX reserve data just below New Years Eve so the report didn’t get the attention it deserved but the drop in euro holdings was dramatic.

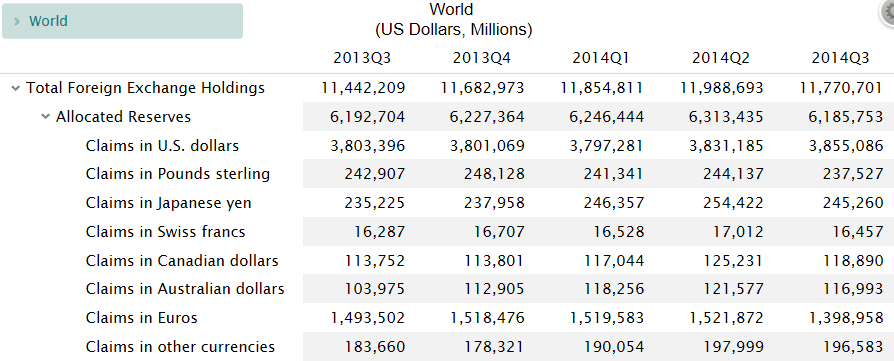

The total share of euros held by central banks fell to 22.6% from 24.1% at the end of Q2. That’s a massive move when quarterly changes usually amount to 0.1-0.2 percentage points.

The euro’s share of reserves is at the lowest since Q3 2002, when the euro was still an untried experiment. Part of the reason might be plain diversification (although the data table below argues against that) or flows related to the Swiss and Russian central banks but someone out there might be worried about the euro’s continued existence. Negative deposit rates (and negative yields on short-term German debt) also make it difficult for anyone to buy/hold the euro.

Another idea might be that reserve managers are traders too and that everyone hates the euro. The thing is, usually central banks are the worst traders.

Global currency reserves overall fell to $11.8 trillion, in the first quarterly drop since the financial crisis in early 2009. Global reserves hit a record $12 trillion just a quarter earlier.

IMF data on world currency reserves