A stagnant economy, prospect of deflation, QE, Greek exit talk, are four of the main reasons why the euro is coming down like the Christmas decorations.

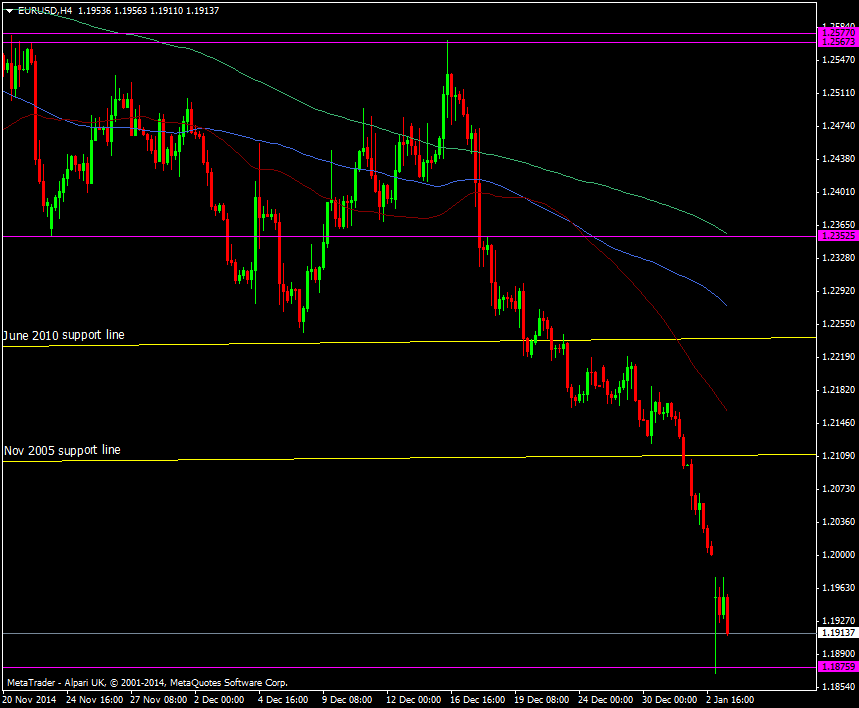

Although it beat the June 2010 low by around 10 pips overnight, I’m calling that a hold of the level. A proper test will be if we have another look in more liquid conditions.

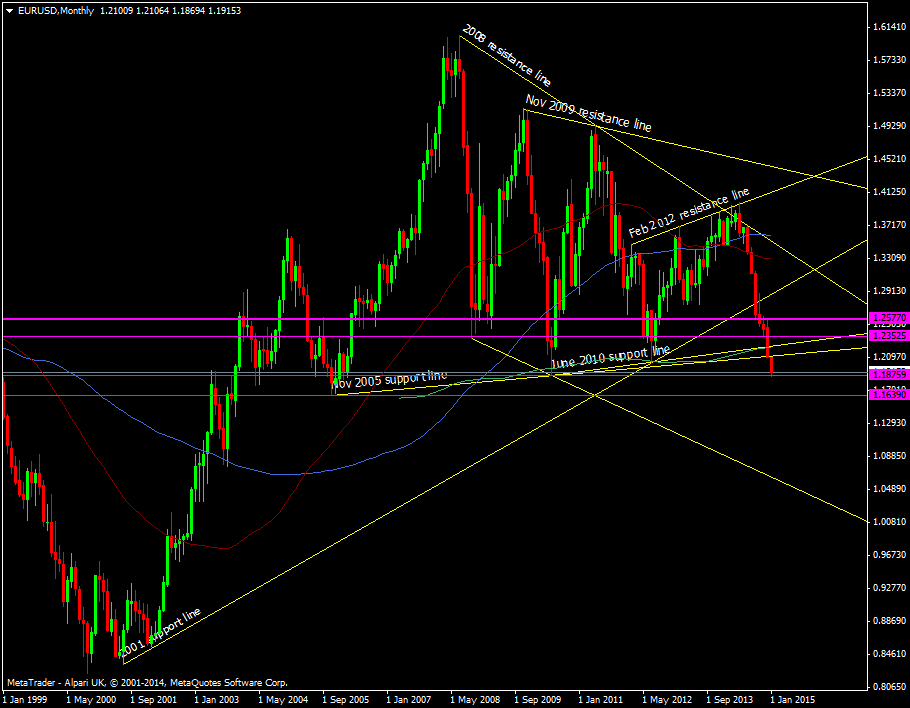

The area around the 1.1875 – 1.1750 saw quite a bit of action as support around 2004/2005 and there’s a potential line in the sand against the Nov/Dec 2005 lows between 1.1639/59

EUR/USD Monthly chart 05 01 2015

If we break below there then the July/Aug 2003 lows could be the next biggish support point before the Oct 2008 decending support line at 1.0625.

That’s a very wide look at the pair but given the funk it’s in now, it’s worth having a look at the bigger technical picture.

Looking closer, the levels to watch above are pretty clear. At the moment 1.1975, which is the bottom of the gap, is resistance and we’re likely to see 1.20 become quite a strong area for bears to defend.

EUR/USD H4 chart 05 01 2015

Further up the Nov 2005 and June 2010 broken support lines will be worth watching, particularly the 2010 line from around 1.2220 to 1.2245/50

Greece is said to be the main driver of the moves by the market jungle drums today, and whether they leave the eurozone. We’ve been here before and I’m inclined to think that it won’t be as big a deal as it was last time. Last time the whole question of Europe was in the balance and the move to keep Greece was more to do with dissuading expectations of an overall collapse of the EZ. It’s quite possible that a Greek exit now wouldn’t be that big a blow to Europe, but we should assume that there will be a strong fight to keep them in. Certainly we shouldn’t see the contagion effects that we saw last time. If the market does go that way then that could well be a fear trade worth fading.

It can be tough to gauge the early days of new years trading as the market re-establishes positions closed pre-holidays and new positions are taken. It’s a bit like the first 10 minutes of a football match where the two sides size each other up. I’d like to see another test of this 1.1865/75 area to see how it performs and if we have a look and it holds I might consider taking a smallish long for a look at those resistance areas I’ve highlighted.

This is a big month for the ECB with everyone looking at the meeting on the 22nd and as I said at the top of the post, there is still no real reason to invest heavily in longer term longs right now.