Seeing USD/JPY fail at 120 today has got me thinking about tomorrow’s jobs report. At the moment fundamentally there is no real reason for the dollar to make another big move up and we’ve seen previously that good jobs reports haven’t lasted long in upward momentum in the dollar. In fact, thinking about the move through 110, it’s come on the back of the BOJ and FOMC action rather than the data.

And so I’m getting that consolidation feeling like I did around 108/109 and tomorrow could be just the confirmation of that.

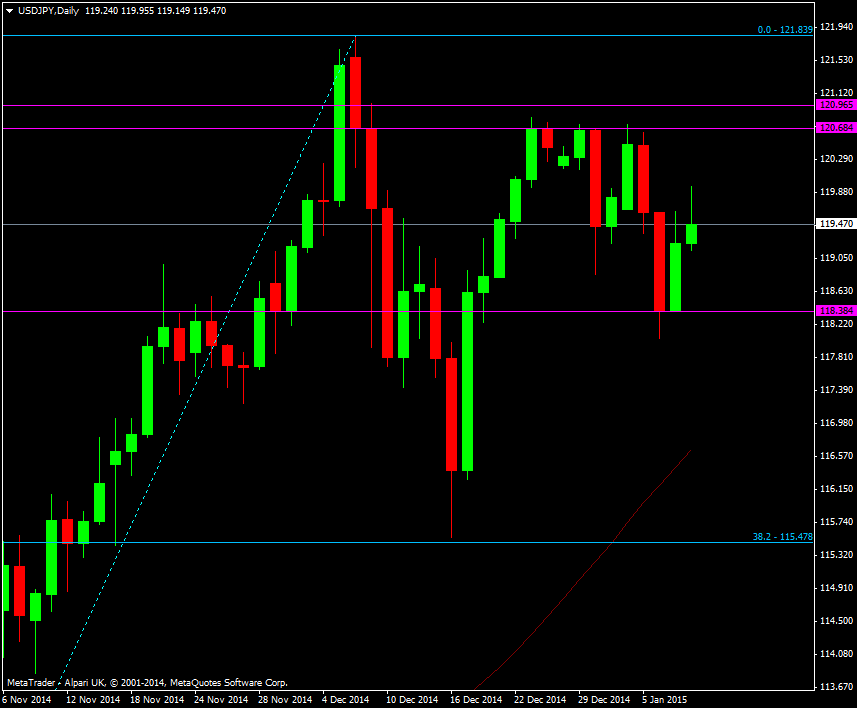

Looking at the daily chart we’ve got some good levels to watch that might give us a shorting opportunity to get in at the top of any consolidation range.

USD/JPY Daily chart 08 01 2015

the 120.65/80 level certainly looks a strong resistance point ahead of 121 and then we have the Dec highs towards 122.00. I’m fancying the 120.65/80 area for a short on a NFP pop if it happens tomorrow, obviously taking into account whatever happens in between.

For the downside, 118.30/50 looks good for support as does the area around 117.45/70. A break below there could see us push down to the 55 dma at 116.65 and the bottom of those Dec candles at 116.40 before another test of the 38.2 fib of the Oct 2014 swing up at 115.50.

There’s enough signs from the current price action to suggest we’re seeing a top for now and enough room between the current price and the stronger levels to get me interested in playing the range.