Australian housing finance for November 2014:

Home loans -0.7% m/m

- expected +1.7%, prior was +0.2%, revised from +0.3%

Investment lending -2.2% m/m

- prior was +0.5% (revised from +1.0%)

- That’s the fasetst fall since January of 2014

Owner-occupied loan value -0.2% m/m

- prior was +1.0%

–

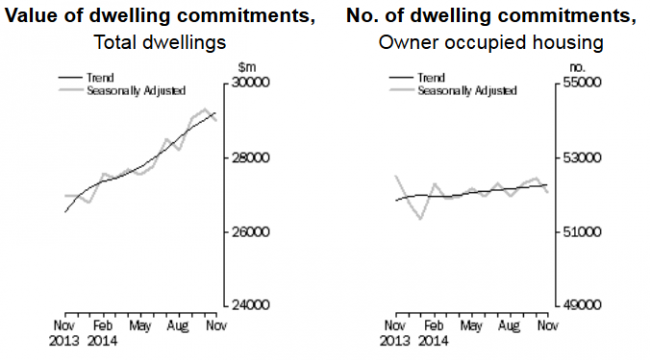

A slowing in housing finance on the month for November.

JPMorgan economist Tom Kennedy:

- ‘‘The overall theme is that the housing market is slowing down a little bit from some very high levels’’

- ‘‘It’s still going in the right direction but things are cooling’’

National Australia Bank senior economist David de Garis:

- ‘‘These monthly numbers are pretty choppy but even so, the dip we have seen in November might help to cool any perceptions, at least for now, of overheating in the housing market”

- The dip may be temporary, given the pickup in home prices in December.

Says ANZ:

- “Investor sales have provided a significant boost to the strong cyclical upswing in the Australian housing market since 2012″

- “In the past year, investor finance has increased over 20%, compared to a little over 5% over the same period for the owner occupier segment”

Westpac:

- Investor finance is trending higher

- Investors continue to move into the housing market

- The Westpac-MI Consumer Sentiment survey indicates that attitudes of owner-occupiers to the housing market is past its peak, retreating from record low levels as house prices advance

- It is encouraging for the outlook of home building that finance for the construction of dwellings moved a little higher over the second half of 2014.tle over 5% over the same period for the owner occupier segment