Forex news of January 15, 2015:

All the SNB news:

- SNB’s Jordan says lowering interest rates will mitigate effects of decision to end cap on franc

- Jordan: Sees most of ECB QE priced into the market

- Expect a long wait over the retail mess in Swiss positions

- All open trades being pulled from retail trading platforms

- SNB intervention cited as CHF pairs and euro recover some losses

- Full SNB press release here

- Reactions to the Swiss National Bank shocker

- Why this is terrible news for the euro

- Are the other swiss pairs a screaming buy after the SNB collapse?

- Swiss National Bank abandons EUR/CHF 1.20 floor – 7 storylines

- SNB move could cause liquidation in popular trades

- Morgan Stanley expects flows into US dollars from SNB

- The SNB didn’t tell Lagarde about its plans

- The tide has gone out for FX brokers after the EUR/CHF collapse

- IG drops a potential £30m after SNB drops 1.20 floor

- Forex broker broker Excel Markets calls it quits on SNB shocker

- GAIN Capital says ‘no material impact’ from Swiss franc

Other news:

- January 2015 US Empire State manufacturing index 9.95 vs 5.00 exp

- January Philly Fed +6.3 vs +18.7 exp

- US initial jobless claims 316k vs 291k exp

- US Dec PPI final demand -0.3% m/m vs -0.4% exp

- Canadian Dec existing home sales -5.8%

- ECB’s Weidmann: ECJ opinion illustrates ECB limits

- BOJ may extend size of 2 loan schemes next week -RTRS

- Belgian police kill two after raids on suspected terrorists

- Target bails on Canada

- Gold up $30 to $1256

- US 10-year yields down 11 bps to 1.74%

- S&P 500 down 18 points to 1993

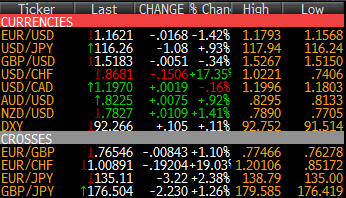

- CHF leads, EUR lags

It was one for the history books today. At 4:30 am ET (930 GMT) the Swiss National Bank announced it was ending the 3-year old floor in EUR/CHF at 1.20. From there it was carnage as the pair fell somewhere between 0.8500 and 0.7000 depending on the screen. At the bottom there were no bids and no liquidity but it was at least a 35% fall, which is unheard of for a major currency.

US traders arrived with EUR/CHF in a fairly tight range around 1.0260 and fresh chatter the SNB was intervening but it hindsight it might have simply been a lack of liquidity and brokers refusing trades. Not long after, the pair slide to 1.0170 before a strong bounce up to 1.0610 to match the bounce in Europe. That set a bit of an intraday double top and it was back down from the to once again match the US low at 1.1070. Needless to say, the technical levels were important. Another bounce from there hit 1.03 but toward the US after the US low gave way and it sparked a quick move to 1.00 where it held for an hour. As liquidity thinned out and New York closing, shorts blasted through and all the way to 0.9730 in a wave of stops. Just as quickly it came back to 1.0079.

The story wasn’t just the Swiss franc today. With so much uncertainty there and stocks already in the midst of four days of losses, there was a swift mood to cut risk and VAR. It led to broad yen buying, especially after the soft Philly Fed. USD/JPY was around 117.00 at the time of the data but as the mood worsened it skidded down to 116.00.

As I arrived, I mused that euro shorts made sense at 1.17 and they did as the pair quickly fell to 1.1571 which was very close to the post SNB low in Europe. The market is interpreting this as a clear sign that ECB sovereign QE is coming. The post-SNB low has held so far and EUR/USD has bounced to 1.1630.

Early in US trading, one of the beneficiaries was the commodity bloc. The thinking there is two-fold. 1) that risk was being pared and commodity currency shorts were being taken off 2) the commodity currencies are a safe-haven of sorts and the yield in Australia and New Zealand is certainly attractive. In spite of all the madness, it was a good day for commodity FX and that means better days could be on the way.

On commodity currency that didn’t fare was well was the loonie. At first it did, as an early push sent it down to 118.00. Mike did a great job of highlighting bids there and the low was 1.1803 but an oil rally failed in spectacular fashion, Target pulled out of Canada and the housing numbers were poor. That turned the trade around and back up to 1.1969. I spoke more with Reuters about USD/CAD today.

For posterity:

FX changes

Doesn’t capture the final minute fall to 0.9731 in EUR/CHF