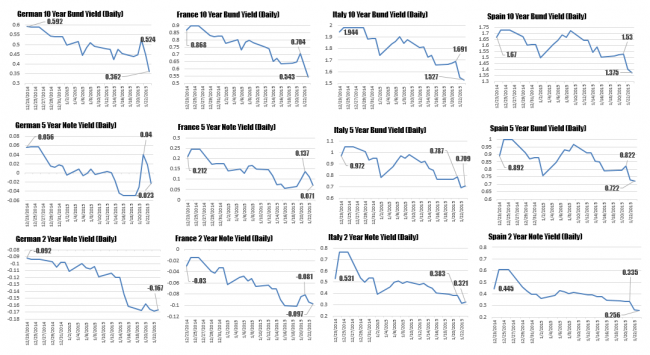

As the European week comes to a close, and the pledge to buy 60B of EU debt per month for 18 months is in the books, how has the trends in the yields of some major EU countries do this week?

EU bond yields

The telegraphing of QE has indeed helped the yields of German, French, Italian and Spanish bonds and notes move lower over the last month of trading (as has the lower inflation from oils rapid decline), but the fact that the QE was twice what was the consensus of $500 or so billion (at least before the leak), the yields got another push lower after the announcement. Heck, there is a new player in town and he has deep pockets.

German 10 year bunds are leading the way with a move down from a 0.524% close on Wednesday, to 0.362% today. That is a huge percentage move (o.36% for 10 years). Italian 10 year yields also fell smartly from 1.691% to 1.527%. Overall, the trends are down and with one of the dogs of the EU, Italy having their yields at 1.527% for 10 years, there is not much meat on the bone for investors, but the money can always go into stocks if you want a higher yield (of course that is not guaranteed but the markets tend to react that way). It may also be pushing on a string to some extent. You still need demand for money to create growth. Nevertheless, you can say the yields in the market are not restrictive.

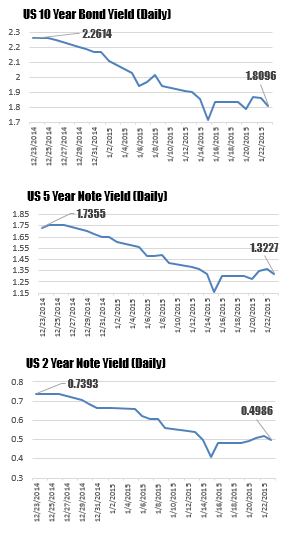

US debt yields

How do the yields in Europe stack up vs. the US?

The rates in the US have enjoyed a similar move over the last month with 10 year yields tumbling from 2.2614% to 1.8096 currently. So the US has not been left behind.

However, across the yield curve, the US yields are higher than all including Spain and even Italy. Against the German Bund, at 0.362% vs 1.8096%, the yield differential is a mile wide. For what it is worth, there are some, like the newly crowned bond king Jeffrey Gundlach who thinks this differential is what will drive US yields even further lower this year. With that rally or without, the differential in the relative yields is dollar supportive and should continue to keep the lid on the EURUSD going forward.

What is potentially worrisome – and I know it has been said before – is rates certainly seem to be really low. You have to wonder, will there be that day where it becomes a fast break the other way.

That is then, this is now. So for the time being, move over global bond traders, we have another new buyer in the market…