The euro sellers took advantage of the Greek elections and thin liquidity to nudge the pair under 1.1100 overnight and the bounce since has been pretty impressive.

It hasn’t got the euro out of the woods just yet but the reaction has potentially underpinned the downside in the short term.

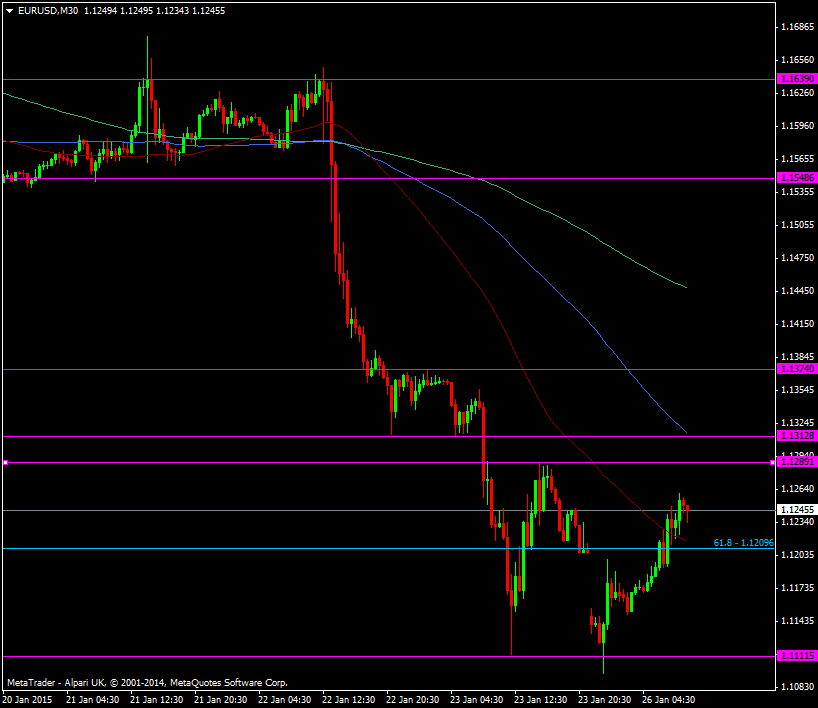

EUR/USD M30 chart 26 01 2015

For the short term we’ve got a few levels in play that we can watch if the euro decides to consolidate for a while.

The 1.1100 level still looks good for a tight long and there’s three points above where shorts can be built. 1.1285/90 is nearest followed by 1.1310/15 and then 1.1375. The 1.1375 level is the one I’d be watching as the most strongest as a break there could open up a bigger bout of sort covering.

From now on the Greek news will be focused on just how far Tsipras wants to push negotiations with Europe and the Troika. Despite “Grexit” being mentioned in virtually every news story an actual exit seems unlikely and both sides might just give a little to settle things down. Politicians are great at promising all and delivering little so we’ll just have to wait to see how tough Tsipras is.

We’re light on the calendar today so barring any major headlines we could well see the euro stay within the range