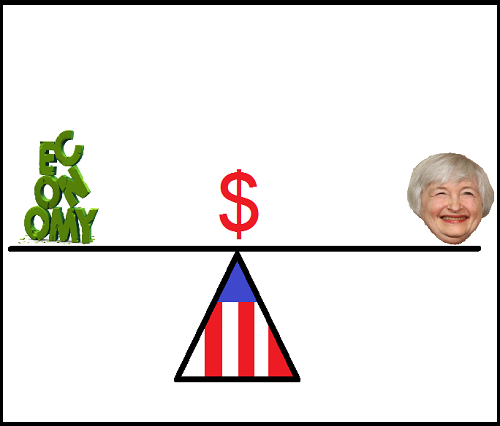

There’s two opposing forces at play in the US trade and it’s helping to keep markets from committing one way or another.

On one side we have the Fed who have all but said they want rates up. To achieve that they want full employment and price stability and are going someway to accomplishing that.

On the other is the economy which has recovered but is a long way from being fully repaired, as well highlighted in Adam’s FOMC preview

In the middle is Mr Market who can’t decide who or what to believe. Does he listen to the Fed and run with the fact that the FOMC fulfilling their mandate meaning rates will be going up, or does he side with the economic data, particularly manufacturing, exports and earnings which suggests that maybe the economy isn’t all it’s cracked up to be?

It’s a tough spot to be in and it will take a marked shift on one side of the balance to tip the market in that direction. Towards Yellen and it’s dollar gains, towards more bad economic news and the dollar goes south. At some point either Yellen or the economy is going to end up in the lap of the other. When that happens we have our direction

Which way next?

For tonight’s FOMC announcement it’s hard to see them changing their current rhetoric. If they don’t create any waves then we’ll see the continued consolidation of the dollar.