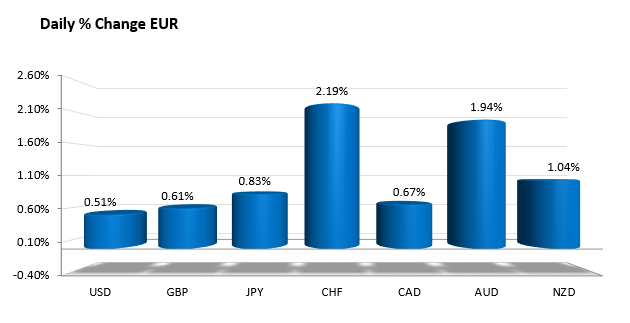

The EURUSD today seems to be getting help from it’s friends in the form of EURCHF, EURAUD and EURNZD. All are doing quite well in trading today with each up at least 1.0% (see chart below).

A snapshot of the EUR change against the major currencies today.

Against the USD, the pair is up more modestly, but still up by 0.51% currently vs. the US 5 PM close.

EURUSD shows short covering potential with 1.1372 area a target.

Looking at the hourly chart, the selling below the 100 hour MA in late NY trading yesterday and asian trading today should have solicited more selling. However, momentum could not be sustained. The pair rotated higher despite really weak German CPI data (see Euro shrugs of German CPI to hit session high) and some low initial claims (caveat: it was a holiday week which has an impact) as well. The trading range for the day is low-ish at 82 pips vs an average over the last 22 days of 123 pips. The pair is making new highs in the current hour. There is room to roam in what is a market that seems short given the fundamentals and the subsequent price action.

The target above looks toward the 1.1372-88 level. The 1.1372 is the low going back to November 2003 (not shown) and the 1.1388 is the 38.2% of the move down from the January 21 high. Going back to January 23rd, the price leaned against this level. There was a brief move above the area on Tuesday, but yesterday the price held below the area again. The 1.13194 is the support now/risk, should the momentum die down.