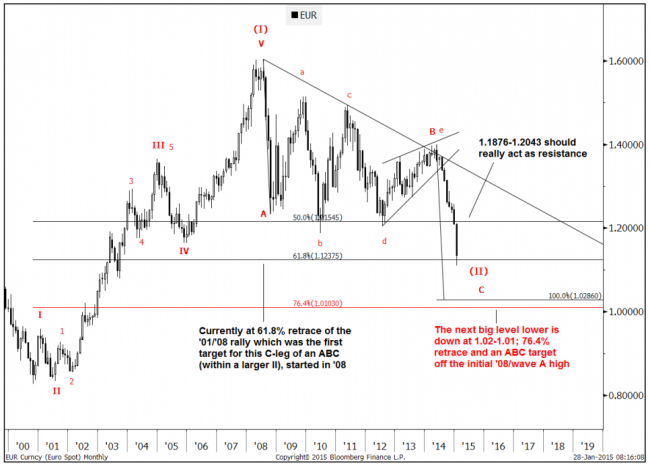

Goldman Sachs EUR/USD technical analysis (with an Elliot Wave perspective)

A Goldman Sachs technical analysis piece ….

They say EUR/USD is holding in around 1.1237; “61.8% of the 2000/2008 rally”:

They go on:

- If at any point this level breaks, there is a decent gap below it that runs down to ~1.0286-1.0103. This next big pivot area encompasses an ABC equality target off the initial Jul./Oct. ‘08 drop and 76.4% retrace from ‘00. It’s also the same distance in percentage terms (~8%) to the projected target on the DXY chart at ~102.50.

- There is a risk however that the move since May ‘14 already satisfies the target for an ABC that started in ‘08. From an Elliott wave perspective, it’s plausible (but not necessary) that the low could already be in place.

- Overall, it seems until the psychologically relevant 1.10 level is broken, it’s best to keep an eye out for any further sign of a correction or base

–

Elliot Wave is not really my thing, but perhaps some of those who use it might like to comment on the interpretation from GS?

(Note – this research piece is from Thursday … buts its pretty big picture stuff)