The Bank of England meet his week, with a pretty much unanimous expectation it'll be an on hold decision

The announcement is Thursday, and will also include

- MPC minutes

- February Inflation Report

and also for publication ...

- Governor Carney's letter on reasons why CPI inflation overshot target in November (2% target, overshoot was by 1 pussent!)

---

Capital Economics with a bit of a preview, though more of a longer look:

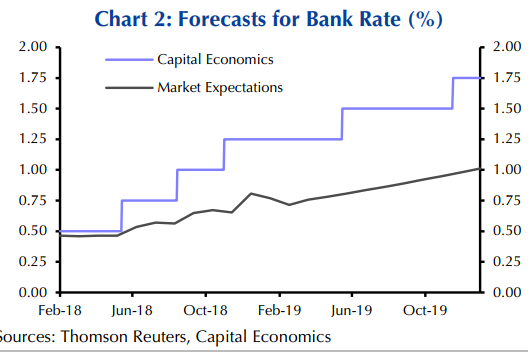

- The Bank of England is the only other major advanced-economy central bank which is likely to raise interest rates this year.

- Admittedly, inflation in the UK is likely to fall to around 2% by year-end as the effect of the post-referendum fall in sterling fades. But this shouldn't prevent the Bank from tightening policy because we expect the economy to remain strong. Indeed, recent news on the economy has been encouraging, with GDP expanding by 0.5% q/q in the Q4 2017, and employment growth picking up.

- In addition, the fall in inflation should ease the squeeze on households' real incomes, and net trade is likely to make a bigger positive contribution to growth. Overall, we expect GDP growth of around 2% this year, slightly higher than last year The upshot is that we think the Bank of England will raise interest rates more than markets are expecting in the coming months. Whereas financial markets are pricing in only one more hike by the end of the year, we expect three rates hikes