An up close and personal view

Anyone who was trading in 2009 will never forget it. The emotion was intense. Every day was a wild ride.

Today marks 10 years since the March 6, 2009 bottom in the S&P 500 at 666. The index is up 4.16x (plus dividends) since then in what has been a remarkable run.

What's often forgotten is how wild it was at the bottom. The paid had already been monumental through mid-February and the economic numbers had begun to flatten. Then the bottom fell out. The S&P 500 fell another 25% in just 18 trading days.

By comparison, what felt like a brutal selloff in 2018 started in early October and took 58 trading days and only amounted to 20%.

Technically, there wasn't a great sign of a bottom. A couple of dojis at best and a bullish candle. Fundamentally there was no big economic release or news item that turned the tide. It was truly a case of buyers simply exhausting themselves and stocks falling to ridiculous valuations.

I remember watch CNBC for months afterwards and so many analysts saying the market 'had to go and retest the bottom'. It never did.

What's incredible is that by March 20 the index had risen nearly 25% from the lows.

Personally, I just decided to look up my old trading statements from that month. I remembered buying stocks right at the lows and my memory was correct. Some of the trades were even better than I thought.

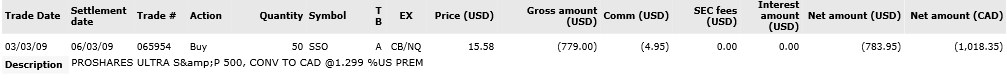

I bought the levered ProShares ultra S&P 500 on March 3.

Unfortunately I sold it a few weeks late for a 50% gain. Normally that would be a spectacular return but in hindsight, it was the wrong way to go about it. First off, I didn't have much money in 2009 so it's all kind of laughable.

An even better trade I made at the bottom was GE. I bought calls on March 4, which was literally the day shares of the company bottomed at 5.50. They were extremely short dated with a March 21 expiration but cost only 37-cents.

In any case, on March 21 the shares closed at $9.90 which means they would have risen 6.5x if I'd been wise enough to hold them.

Looking back, it doesn't matter that I was right at the bottom. I was far too reckless and going into trades where I couldn't stomach the volatility without doing something stupid (like selling too early).

The lesson I've learned many times since, and finally absorbed, is that you need to trade at sizes where you're comfortable. I'm sure at the time, that $1000 seemed like a lot to have on a trade. The volatility of the trades was also extremely high with options and levered ETFs.

The lesson is that time is on your side. Some people can handle wild swings and keep a cool head, but it's rare. In general, the best thing you can do is play the long game when things get crazy and usually the only way to do that is to trade small and buy things you're very confident it.