Timing is everything

There are certain times in the markets that present risks and opportunities. In the market, different times have different characteristics. This is true on a day to day basis.

For example, at the end of the US and before the Asian session the market becomes particularly illiquid and flash crashes can move the market hundreds of points on very little. This is a vulnerability that occurs at certain times.

In a similar way, the end of the month and end of financial years have influences on different currencies too. This article will focus on year-end markets and both the risks and opportunities that lie within them.

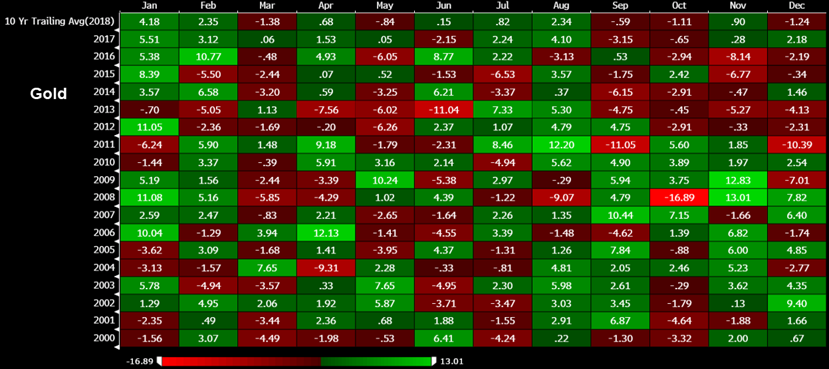

Buying gold on the last day of the year

One of the best ways to end the year is to consider buying Gold at the end of December in anticipation of the strong pattern of buying Gold, which takes place with a surprising regularity, in the month of January.

Over the last few years this seasonal pattern has shown particular strength. If you include the months for February and March too there has only been negative returns once, in 2013. This year presented a really good opportunity to take advantage of this pattern as there were also strong fundamental reasons to buy Gold.

The concern over the US-China trade war accelerated as President Trump became more and more vocal in his combative stance. The market feared that a hostile trade war between the US and China, which constitute around 40% of the entire world's GDP, would spark a global slowdown in growth.

The result was that Gold was bought as a safe haven currency into year-end as US equities plummeted. Cryptocurrencies had also declined during the year as an alternative safe haven and Gold technicals looked good with a close above the highs of $1244. It was a great year start for Gold as usual.

Japanese financial year end in March

At the end of the Japanese financial year, which is at the end of March, many Japanese firms look to consolidate the years profits. As Japanese firms move their profits they bring them back home by buying the Japanese Yen.

These Yen flows are typically seen in the last couple of weeks into March and end around three days before the end of the month. One of the best times to see these Yen flows coming into the market is around the London Fix.

The London Fix starts at around 1600GMT each weekday and this is when a number of FX transactions occur out of London. The characteristic of these transactions at this fixing timing is that they are not run by speculators, but they are normal businesses who are having their money exchanged for purchases and employers etc.

In this instance there can be an uptick in JPY buying as Japanese firms repatriate their profits. This JPY repatriation is not necessarily an easy phenomenon to trade, but it still serves to offer some explanation for strange JPY moves into Japanese year end and traders should be particularly aware of trading any JPY pair in the last two weeks of March around the London fix.

The January effect

There are strong tax and psychological reasons that mean a number of stocks show what is known as 'the January effect'. This is simply reference to a widely anticipated cyclical pattern in stock markets that occurs for a number of reasons.

Sometimes, investors are simply closing their profits for the year and some investment firms are wanting to ensure they book their year-end profits and so they close their positions going into November and December.

There is also a tax incentive and losing trades can be closed at year end to offset any tax implications of winning trades already booked. The impact seems to be seen most acutely in small caps.

One study conducted by the firm Salomon Smith and Barney between 1972 and 2002 found that the stocks of the Russell 2000 index outperformed stocks in the 1000 index during the month of January. The interesting thing to note was that the outperformance was around 0.82%, but the stocks underperformed during the rest of the year.

The usefulness of this fact has been questioned by some due to the necessary transaction costs in trying to capitalize on it. However, possessing strong fundamental reasons to purchase a stock at this time means that you potentially benefit from a year-end tail wind.

Year-end USD demand starts in November

At the end of the year there is demand for USD and typically speaking November is good month for broad USD strength. Over the last 5 years the Bloomberg Dollar Index (BBDXY) has increased +1.6% during November and that increases to +1.8% if you go back over the last 10 years.

The conventional wisdom is that USD buying takes place in December, whereas there is greater evidence of USD buying in the month of November as opposed to December.

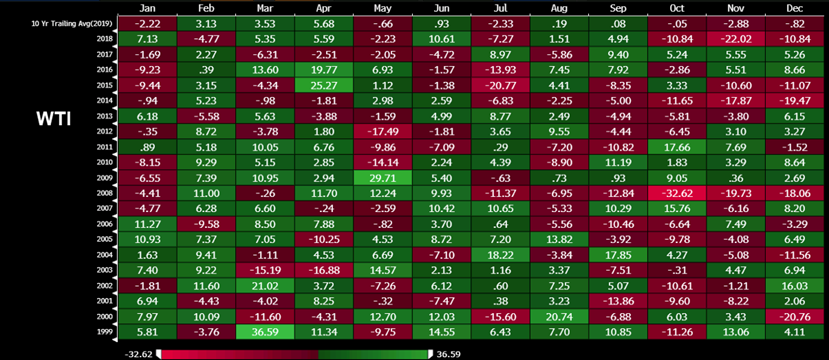

The year-end oil effect

Oil has a very strong year-end effect and it tends to have a period of depreciation at the end of the year. In the month of October Oil prices have fallen 13 times and that general pattern of weakness has often flowed through to the months of November and December.

By contrast, the months of February through to April are typically strong seasonal times for Oil. Therefore, traders should be particularly alert as we approach year end for fundamental reasons to short Oil as a strong seasonal pattern may give you a tail wind.

Similarly, although this article is about year-end markets, it is worth pointing out that February should be considered for potential long US Oil positions. This year, that trade has already played out well for the month of February as OPEC cut their oil production levels, Venezuelan and Iran sanctions further hit supply and US oil rigs numbers steadily fell. It proved to be an excellent example of a strong seasonal pattern reinforced by good fundamentals.

So, there you have it, year-end markets offer opportunities and risks, so look out for these characteristics for the end of 2019.

This article was written by the ADSS Research Team.