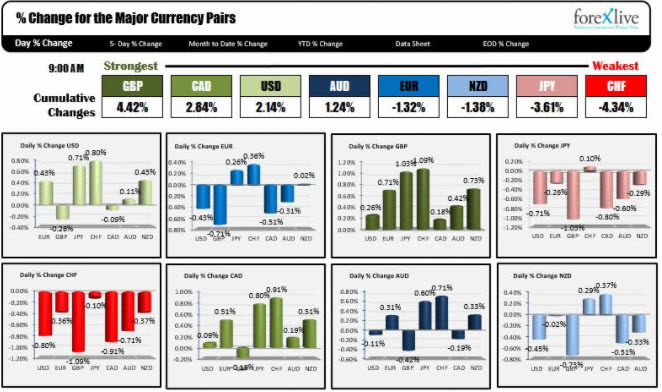

GBP is the strongest. THe CHF is the weakest.

A quick look at the winners and losers as North American traders get at it shows the GBP on the back of Brexit optimism. The CHF is lower on the back of the flight out of the safety of that pair after the weekend developments (Flynn and the GOP tax reform passing). The USD is maintains some of it's gains after the weekend developments but is lower vs. the GBP and the CAD.

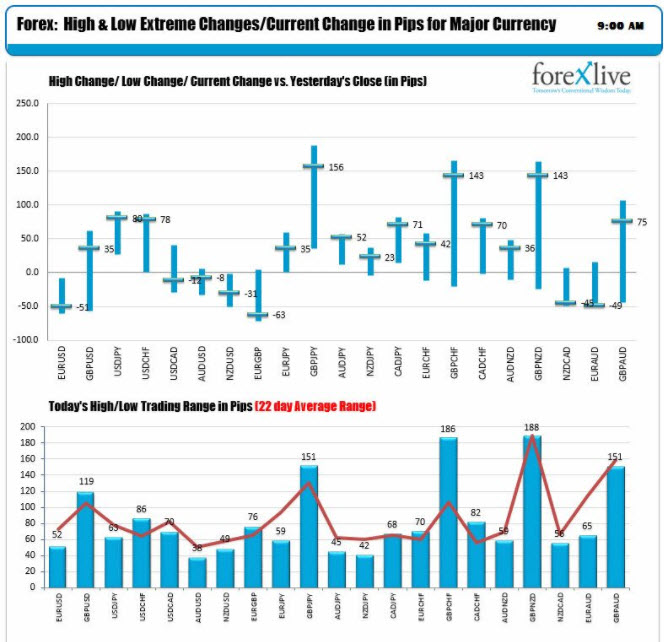

The changes and ranges show pretty good activity. The snapshot shows the USDJPY and USDCHF are near high levels. The GBPUSD was down over 50 pips before reversing and rising more than 50 pips. The pair is up 35 pips at the moment and the range for the day is above its 22 day average (about a month of trading).

The snapshot of other markets are showing:

- Spot gold down $6.22 or -0.49% at $1274.30

- WTI crude oil futures are down $.74 or -1.25% at $57.65

- US yields higher but all the highest levels. Tier 1.798%, +2.6 basis points. The high reach 1.81%. 10 year 2.390%, +2.8 basis points. The high reached 2.418%. The 30 year is 2.787%, +2.6 basis points. The high reached 2.8159%

- US stocks are expected to open higher. The S&P futures are up 14.75 points. Dow futures are up 220 points. NASDAQ futures are up 31 points. They are up on tax reform optimism

- Bitcoin is trading at $11,350 up $450 or 4.14%. The high reached 11,845. The low extended to 10,549