ANZ on the CFTC's positioning data is for the week ending 24 October 2017, focusing on levered funds

In summary (bloding mine):

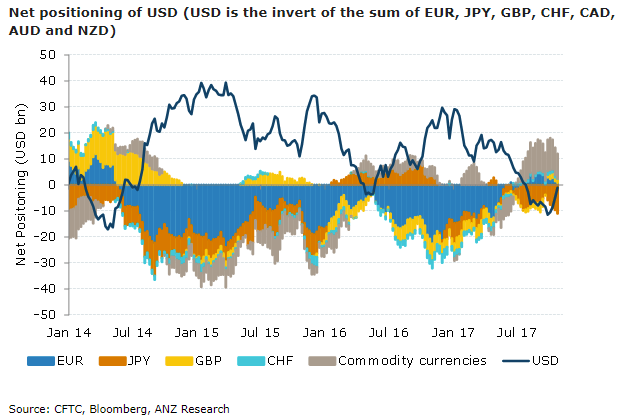

- Leveraged funds were net buyers of USD for the fourth consecutive week. Overall net short USD positions were reduced by USD3.7bn to USD1bn, the lowest net shorts since July this year

- Dollar demand was broad-based, but the most USD buying was seen against the JPY with net JPY shorts reaching the highest since June 2015. Net EUR longs were trimmed ahead of ECB meeting, with net GBP longs also modestly cut

- Commodity currencies saw a combined net selling of USD0.9bn. As one would expect, NZD saw the most selling of USD0.5bn to turn the position into a net short of USD0.2bn, the first short NZD position since May this year

Speaking of Commitments